What Is The Present Value Of Annuity Business Accounting

Present Value Of An Annuity How To Calculate Examples The present value of an annuity is the current value of future payments from an annuity, given a specified rate of return, or discount rate. the higher the discount rate, the lower the present. Present value of an annuity: definition. the present value of an annuity refers to the present value of a series of future promises to pay or receive an annuity at a specified interest rate. the value today of a series of equal payments or receipts to be made or received on specified future dates is called the present value of an annuity.

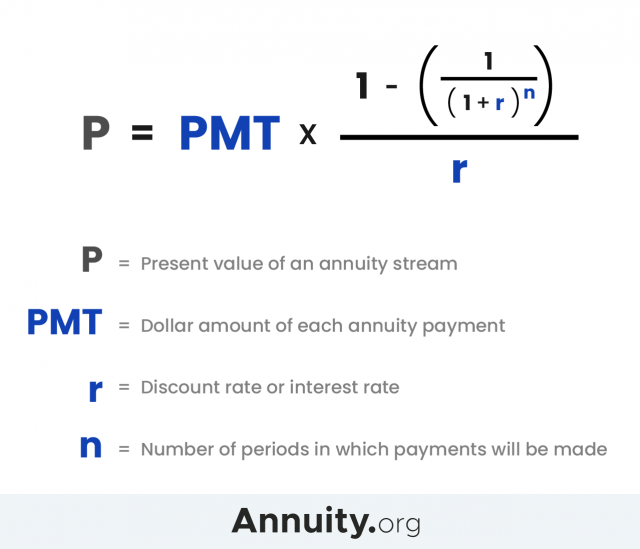

Present Value Of An Annuity How To Calculate Examples The formula for calculating the present value of an ordinary annuity is: p = pmt [ (1 (1 (1 r)n)) r] where: p = the present value of the annuity stream to be paid in the future. pmt = the amount of each annuity payment. r = the interest rate. n = the number of periods over which payments are made. an annuity table is used to determine. The formula to calculate the present value of an ordinary annuity is: p v = p m t × (1 − (1 r) − n) r. where p v is the present value of the annuity, p m t is the constant payment made each period, r is the periodic interest rate, and n is the total number of periods. The present value of an annuity (i.e., series of equal payments, receipts, rents) involves five components: present value; amount of each identical cash payment; time between the identical cash payments; number of periods that the payments will occur; length of the annuity; interest rate or target rate used for discounting the series of payments*. Harold averkamp, cpa, mba. in present value calculations, an annuity is a series of equal cash amounts occurring at equal time intervals. the identical cash amounts are sometimes referred to as payments, receipts, or rent. some examples of business transactions that form an annuity include:.

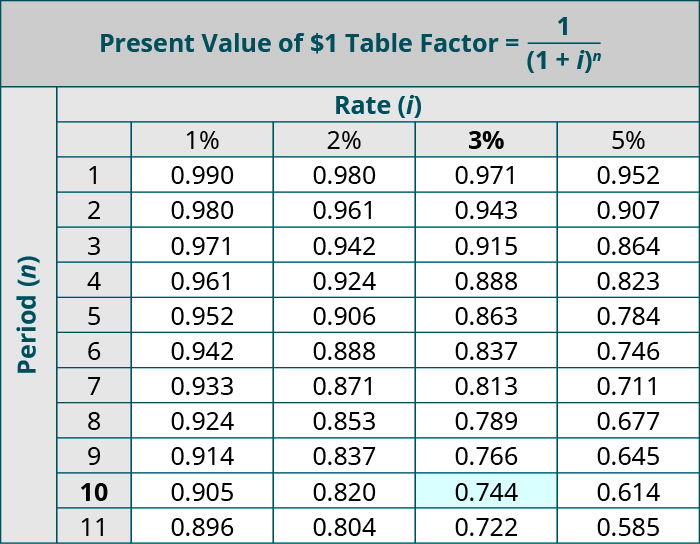

What Is The Present Value Of Annuity Business Accounting The present value of an annuity (i.e., series of equal payments, receipts, rents) involves five components: present value; amount of each identical cash payment; time between the identical cash payments; number of periods that the payments will occur; length of the annuity; interest rate or target rate used for discounting the series of payments*. Harold averkamp, cpa, mba. in present value calculations, an annuity is a series of equal cash amounts occurring at equal time intervals. the identical cash amounts are sometimes referred to as payments, receipts, or rent. some examples of business transactions that form an annuity include:. An annuity table is a tool that simplifies the calculation of the present value of an annuity. also referred to as a “present value table,” an annuity table contains the present value interest factor of an annuity , which you then multiply by your recurring payment amount to get the present value of your annuity. calculating the interest rate. In this case, $2,200 is the future value (fv), so the formula for present value (pv) would be $2,200 ÷ (1 0. 03) 1. the result is $2,135.92. so if you were to be paid now you'd need to receive.

Present Value Of Annuity Formula What Is It An annuity table is a tool that simplifies the calculation of the present value of an annuity. also referred to as a “present value table,” an annuity table contains the present value interest factor of an annuity , which you then multiply by your recurring payment amount to get the present value of your annuity. calculating the interest rate. In this case, $2,200 is the future value (fv), so the formula for present value (pv) would be $2,200 ÷ (1 0. 03) 1. the result is $2,135.92. so if you were to be paid now you'd need to receive.

Present Value Of Annuity Due Formula Calculator With Excel Template

Comments are closed.