What Is An Annuity Table And How Do You Use One

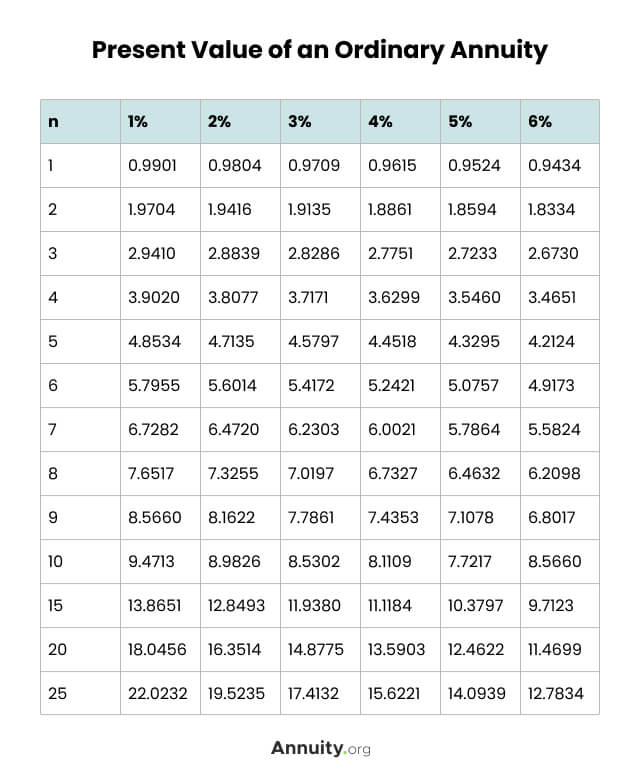

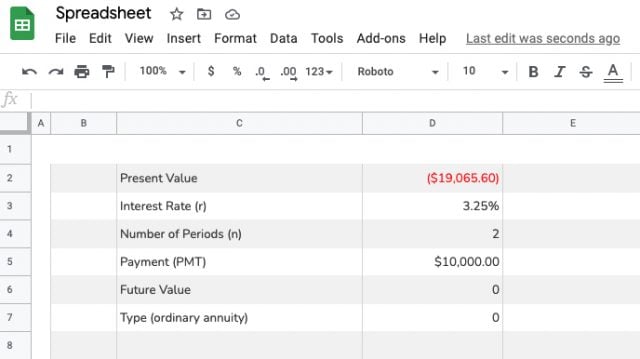

What Is An Annuity Table And How Do You Use One An annuity is a contract between you and an insurance company. the goal is to provide you with guaranteed income in the future, typically in retirement. you can purchase an annuity by making a. An annuity table, often referred to as a “present value table,” is a financial tool that simplifies the process of calculating the present value of an ordinary annuity. by finding the present value interest factor of an annuity (pvifa) on the table, you can easily determine the current worth of your annuity payments. get an annuity quote.

What Is An Annuity Table And How Do You Use One If you multiply this 12.7834 factor from the annuity table by the $50,000 payment amount, you will get $639,170, almost the same as the $639,168 result in the formula highlighted in the previous. An annuity table helps you determine the value of an annuity. here's how it works, and how to read and interpret one. An annuity table is a mathematical tool that helps individuals calculate the present or future value of an annuity based on various factors such as time period and interest rate. it is a compilation of factors known as annuity factors, which simplify the calculation process by providing predetermined values for specific scenarios. Annuity tables perform the majority of the mathematical arithmetic for you. all you have to do is multiply the annuity payment’s value by the factor the table provides to get an idea of what the annuity is currently worth. let us say, for example, you have two options: get paid a one time lump sum of $5,000 now; get paid $5,000 at the end of.

Comments are closed.