What Is An Annuity Loan

:max_bytes(150000):strip_icc()/Term-a-annuity-d4d5906faea940828244ef128f416cc5.jpg)

Guide To Annuities What They Are Types And How They Work An annuity is a contract between a buyer and an insurance company that provides the buyer with a regular series of payments in return for a lump sum payment. an annuity is most commonly used to. Note that you can only use a deferred annuity in its accumulation phase for an annuity loan. you can not take an annuity loan out on an immediate annuity although you may be able to sell the stream of income payments for a discounted lump sum. a non qualified annuity is an annuity you fund with post tax dollars. this contrasts with a qualified.

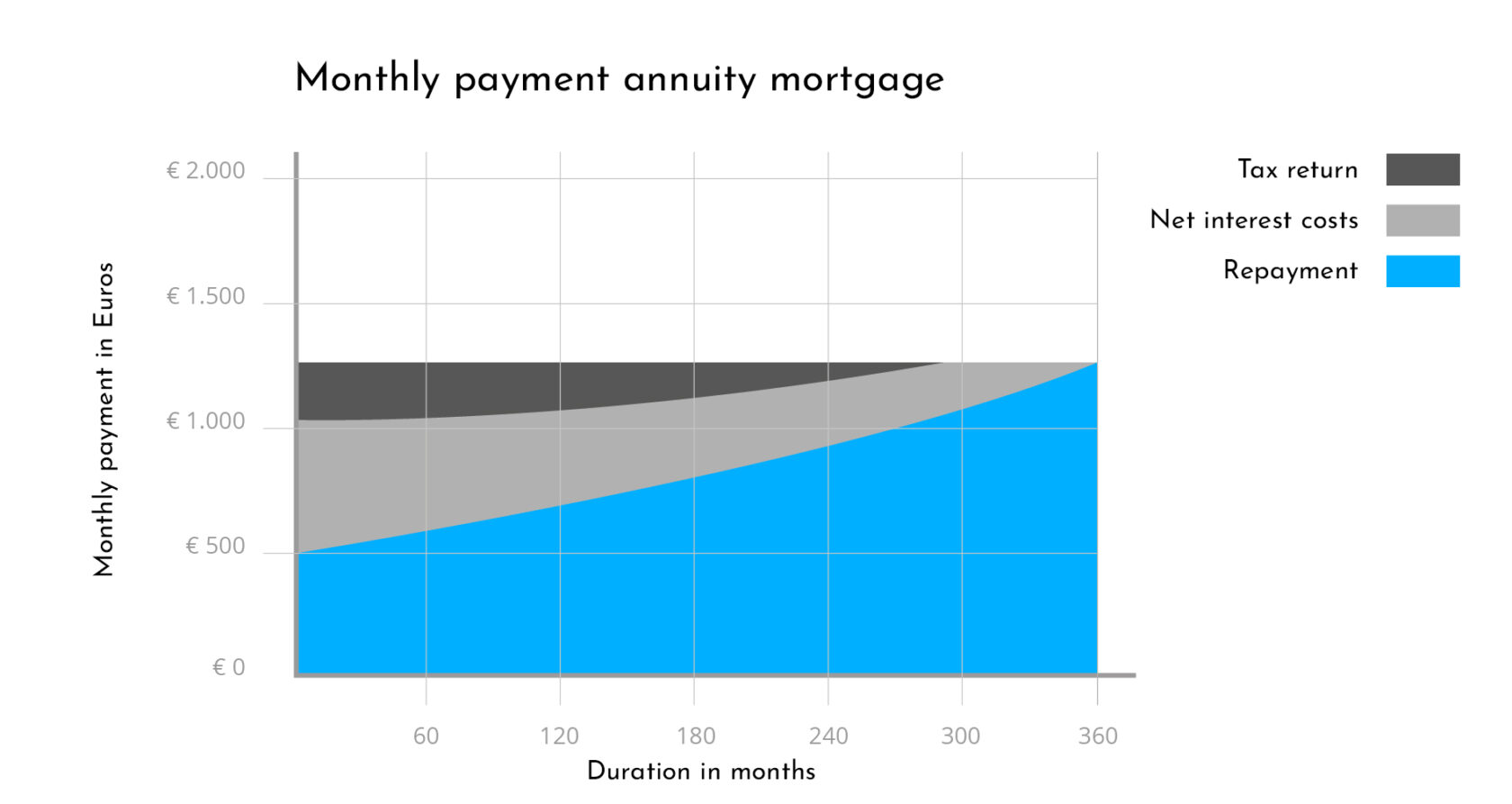

Annuity Mortgage This Is How It Works Viisi Expats When you take out an annuity loan, you borrow money using your annuity as collateral. the loan amount is usually a percentage of the annuity’s cash value. you repay the loan with interest over a specified period. if you fail to repay, your annuity benefits may be reduced, impacting your retirement income. benefits of annuity loans. An annuity is a financial contract between an annuity purchaser and an insurance company. the purchaser pays either a lump sum or regular payments over a period of time. An annuity loan is a financial arrangement in which you leverage your annuity to get a loan. you can do this by using your annuity as collateral to get a loan from a bank, or by borrowing money directly from your contract. an annuity is a contract between you and an insurance company. you’ll purchase the annuity with premiums, and in exchange. An annuity is a financial contract that provides a stream of payments later in return for an investment now. auto loans auto loans guide best auto loans for good and bad credit best auto loans.

Comments are closed.