Present Value Of Annuity Due Table Excel Bruin Blog

Present Value Of Annuity Due Table Excel Bruin Blog With an annuity due, payments are made at the beginning of the period, instead of the end. to calculate present value for an annuity due, use 1 for the type argument. in the example shown, the formula in f9 is: = pv (f7,f8, f6,0,1) note the inputs (which come from column f) are the same as the original formula. the only difference is type = 1. No. of years (c3): 1. future value (c4): 11,000. the formula to calculate the present value of the investment is: =pv(c2, c3, ,c4) please pay attention that the 3 rd argument intended for a periodic payment (pmt) is omitted because our pv calculation only includes the future value (fv), which is the 4 th argument.

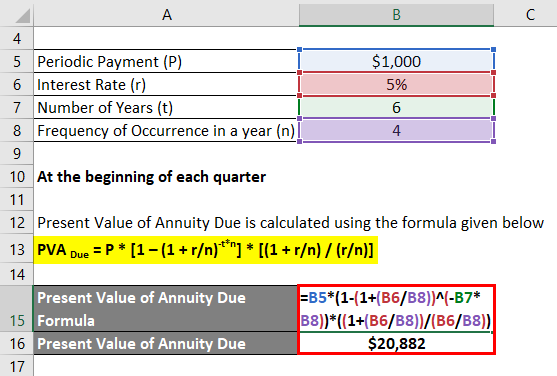

Present Value Of Annuity Due Table Excel Bruin Blog The complete pv formula in b8 is: =pv(b2 b6, b3*b6, b4,, b5) in a similar manner, you can calculate the present value of a weekly, quarterly or semiannual annuity. for this, simply change the number of periods per year in the corresponding cell: weekly: 52. monthly: 12. Step 2) for the rate argument, refer to the interest rate. step 3) for the nper argument, refer to the number of years. step 4) for the nper argument, refer to the periodic payments to be made. step 5) omit the pv and type argument. step 6) and hit enter. excel returns the fv of this annuity as $256,611.41. This function returns the present value of an annuity, loan or investment based on a constant interest rate. again, we will determine present value for both ordinary annuity and annuity due types. 2.1 – present value of an ordinary annuity. to calculate the present value of an ordinary annuity: in cell c11, insert the formula below:. The formula to calculate the present value of an annuity due is given by: where: is the present value of the annuity due, is the payment amount, is the interest rate per period, and; is the total number of periods. procedures in excel. to calculate the present value of an annuity due in excel, you can use the pv function. the formula syntax is.

Present Value Of Annuity Due Table Excel Bruin Blog This function returns the present value of an annuity, loan or investment based on a constant interest rate. again, we will determine present value for both ordinary annuity and annuity due types. 2.1 – present value of an ordinary annuity. to calculate the present value of an ordinary annuity: in cell c11, insert the formula below:. The formula to calculate the present value of an annuity due is given by: where: is the present value of the annuity due, is the payment amount, is the interest rate per period, and; is the total number of periods. procedures in excel. to calculate the present value of an annuity due in excel, you can use the pv function. the formula syntax is. Alternative formula for the present value of an annuity due. the present value of an annuity due formula can also be stated as. which is (1 r) times the present value of an ordinary annuity. this can be shown by looking again at the extended version of the present value of an annuity due formula of. this formula shows that if the present value. Present value of an annuity with continuous compounding. p v = p m t (e r − 1) [1 − 1 e r t] (1 (e r − 1) t) if type is ordinary annuity, t = 0 and we get the present value of an ordinary annuity with continuous compounding. p v = p m t (e r − 1) [1 − 1 e r t] otherwise type is annuity due, t = 1 and we get the present value of an.

Comments are closed.