Present Value Of An Annuity Time Value Of Money Example Cpa Exam Far

Present Value Pv Of An Ordinary Annuity Formula With Examples Time Value Of Money Youtube In is video, i work an example concerning present value of an annuity. the present value of an annuity refers to how much money would be needed today to fun. For more visit: farhatlectures #cpaexam #corporatefinance #accountingstudent this video explain the computation of present value of annuities.#cpaexa.

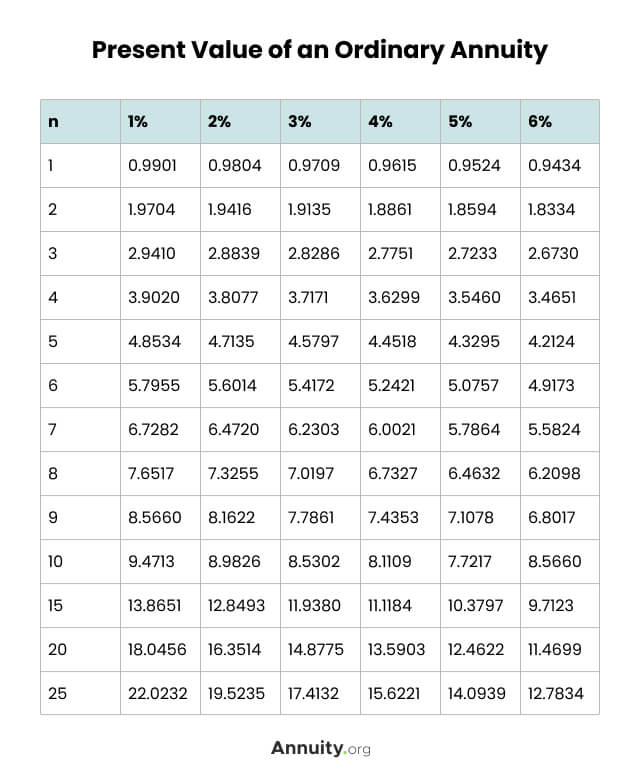

What Is An Annuity Table And How Do You Use One It would be worth $78,300. when you have to calculate the time value of money for the cpa exam, the problems provide you with the specific factors you need to use. the next type is for the present value of an ordinary annuity. annuity means that you’re not just getting a one time payment, but you’re getting a payment every year. Here are some steps to take: step 1: understand the difference between fixed cash flows and uneven cash flows. cash flows that are fixed over a period of time – the same amount of cash is being paid or received every period – is known as an annuity. if the first payment occurs at the very beginning it’s called an annuity due, and if it. Present value and future value questions far. studying for far for context: so i'm going through rogers cpa and i just started the pp&e with asset retirement obligation stuff. in some of the examples hes going through, he has to find the present value of future costs but he does it so quickly. i remember using present value and future value. This playlist discusses compound interest, annuities, and present value. these techniques are used in financial reporting to analyze cash inflows and outflow.

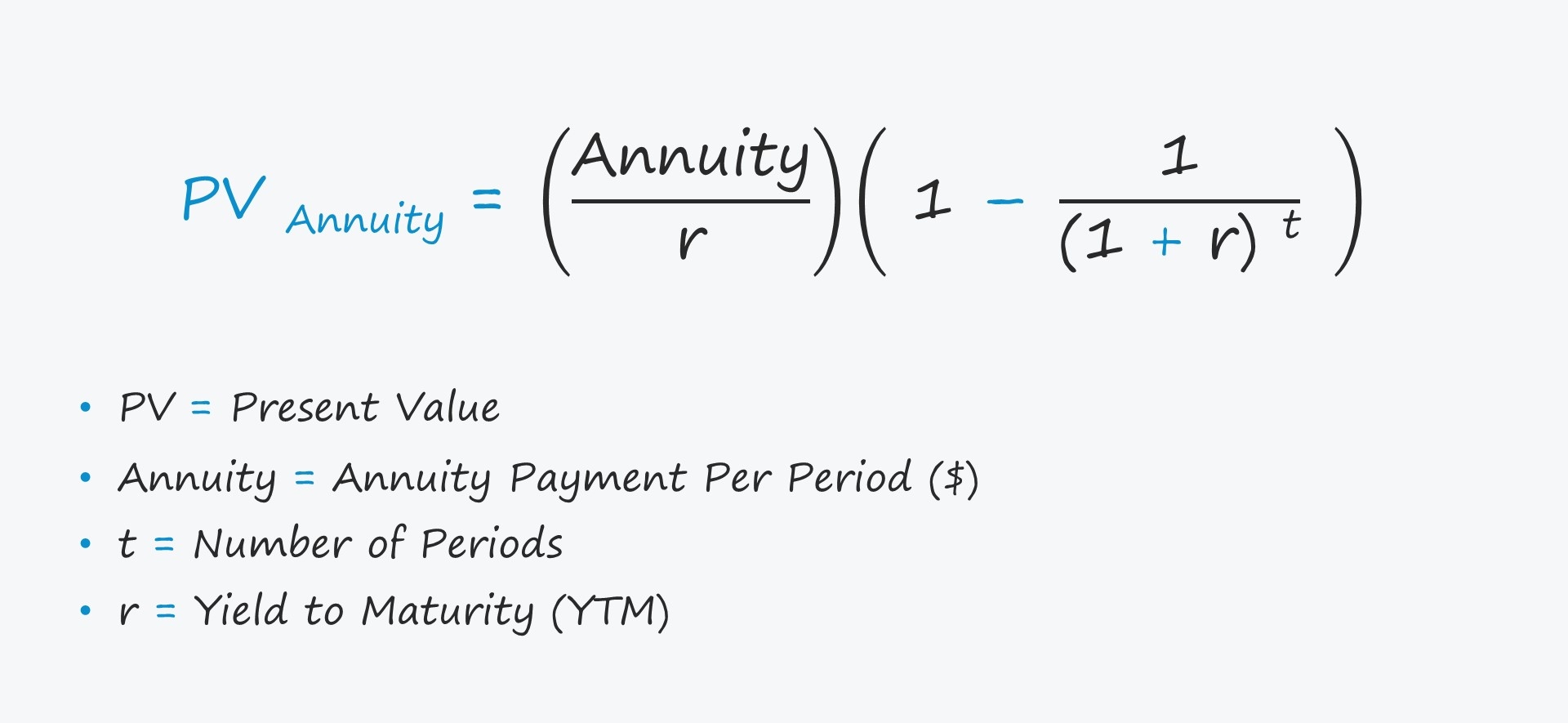

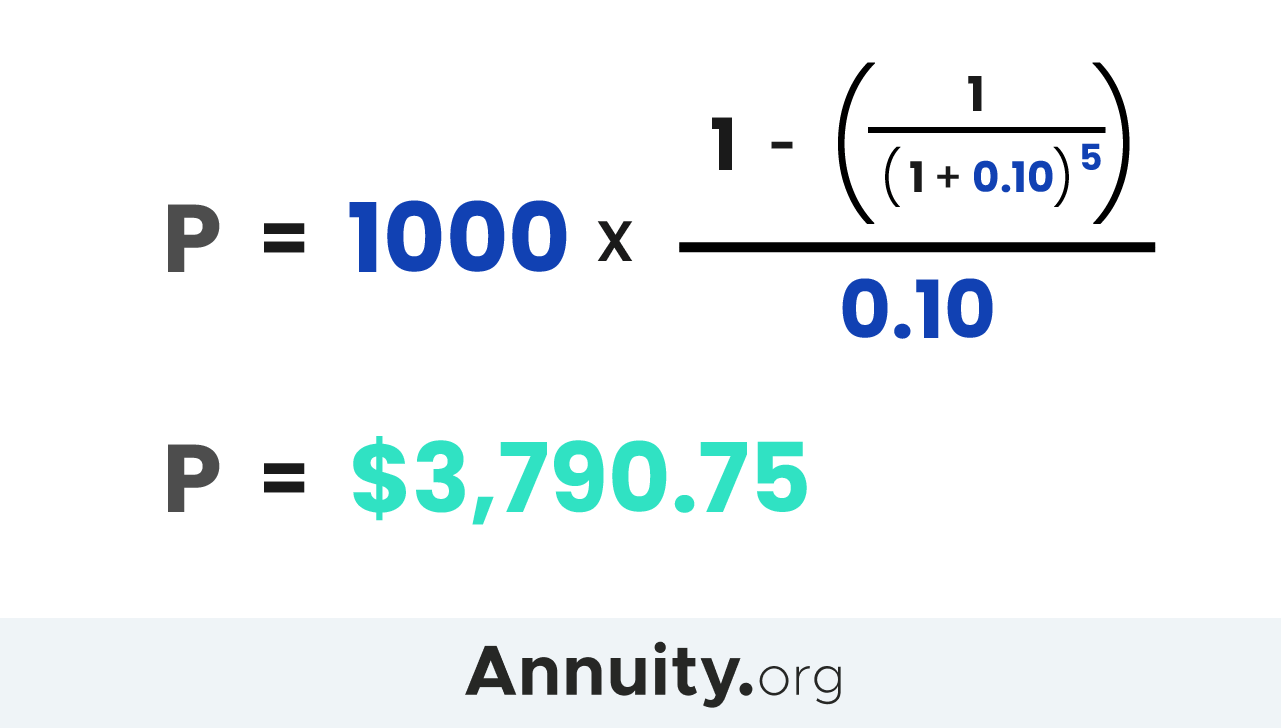

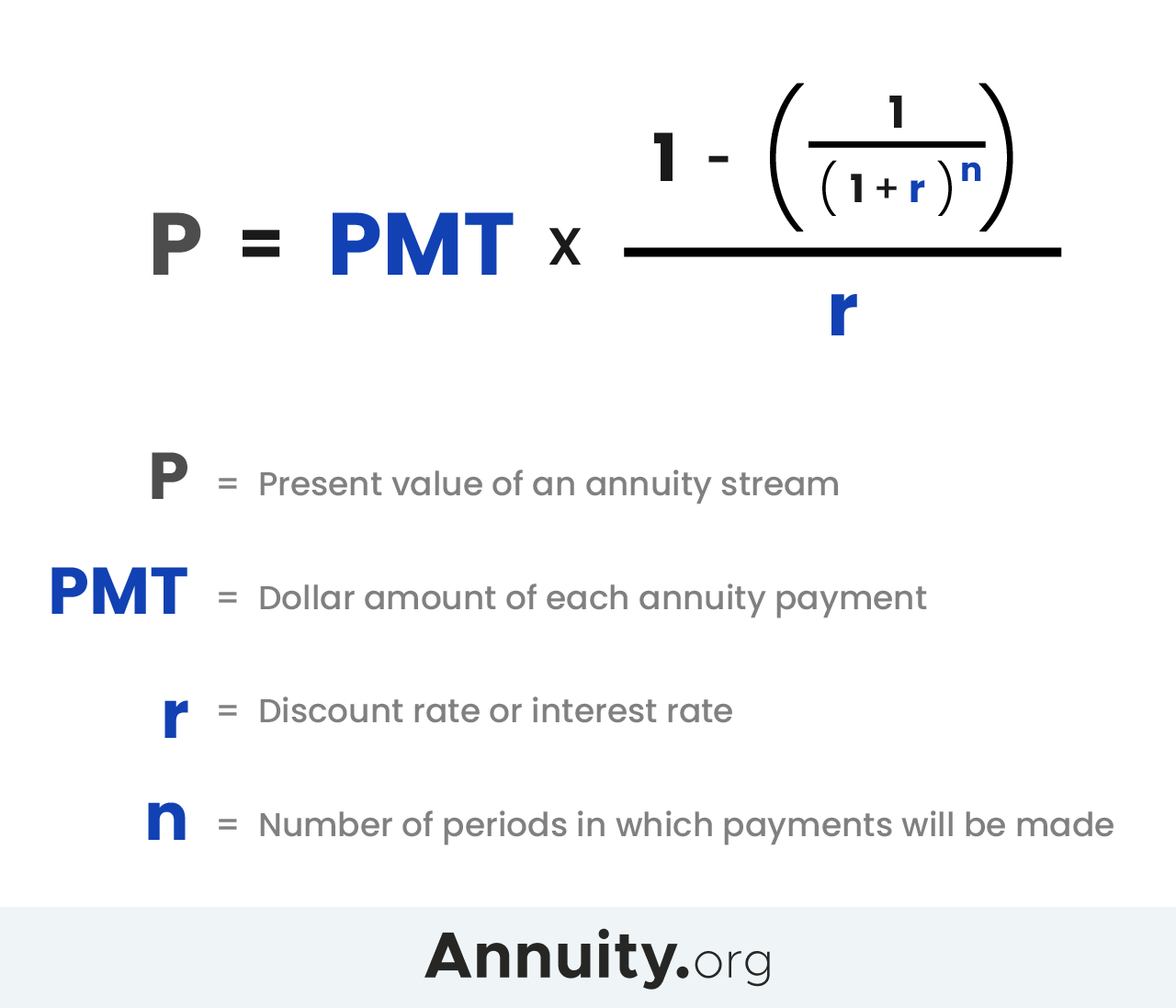

Present Value Of Annuity Due Calculator Keirenecully Present value and future value questions far. studying for far for context: so i'm going through rogers cpa and i just started the pp&e with asset retirement obligation stuff. in some of the examples hes going through, he has to find the present value of future costs but he does it so quickly. i remember using present value and future value. This playlist discusses compound interest, annuities, and present value. these techniques are used in financial reporting to analyze cash inflows and outflow. When we compute the present value of annuity formula, they are both actually the same based on the time value of money. even though alexa will actually receive a total of $1,000,000 ($50,000 x 20) with the payment option, the interest rate discounts these payments over time to their true present value of approximately $426,000. The present value of an annuity refers to how much money would be needed today to fund a series of future annuity payments. because of the time value of money, a sum of money received today is.

Present Value Of An Annuity How To Calculate Examples When we compute the present value of annuity formula, they are both actually the same based on the time value of money. even though alexa will actually receive a total of $1,000,000 ($50,000 x 20) with the payment option, the interest rate discounts these payments over time to their true present value of approximately $426,000. The present value of an annuity refers to how much money would be needed today to fund a series of future annuity payments. because of the time value of money, a sum of money received today is.

Present Value Annuity Factor

Comments are closed.