Present Value Annuity Table Brokeasshome

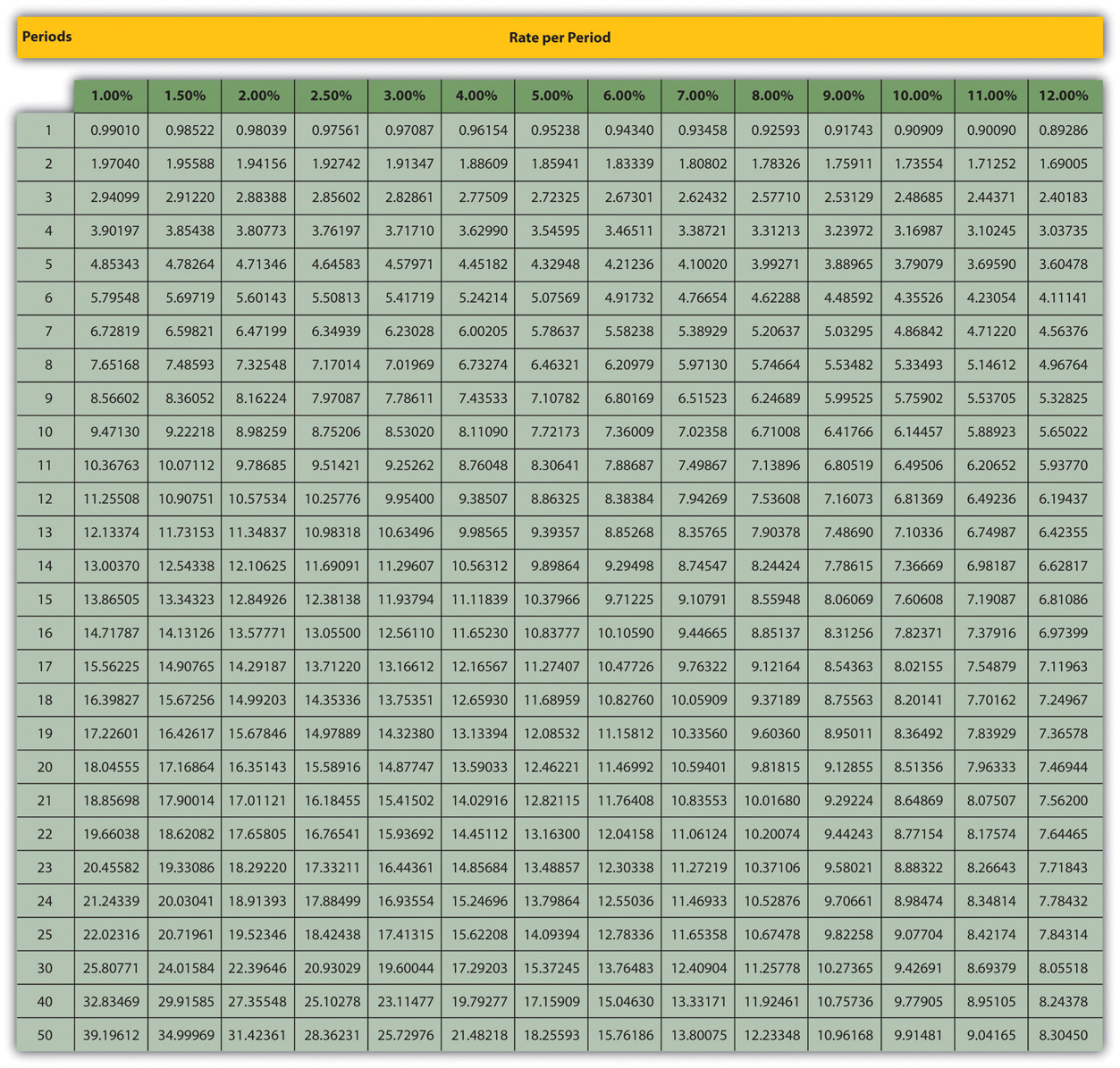

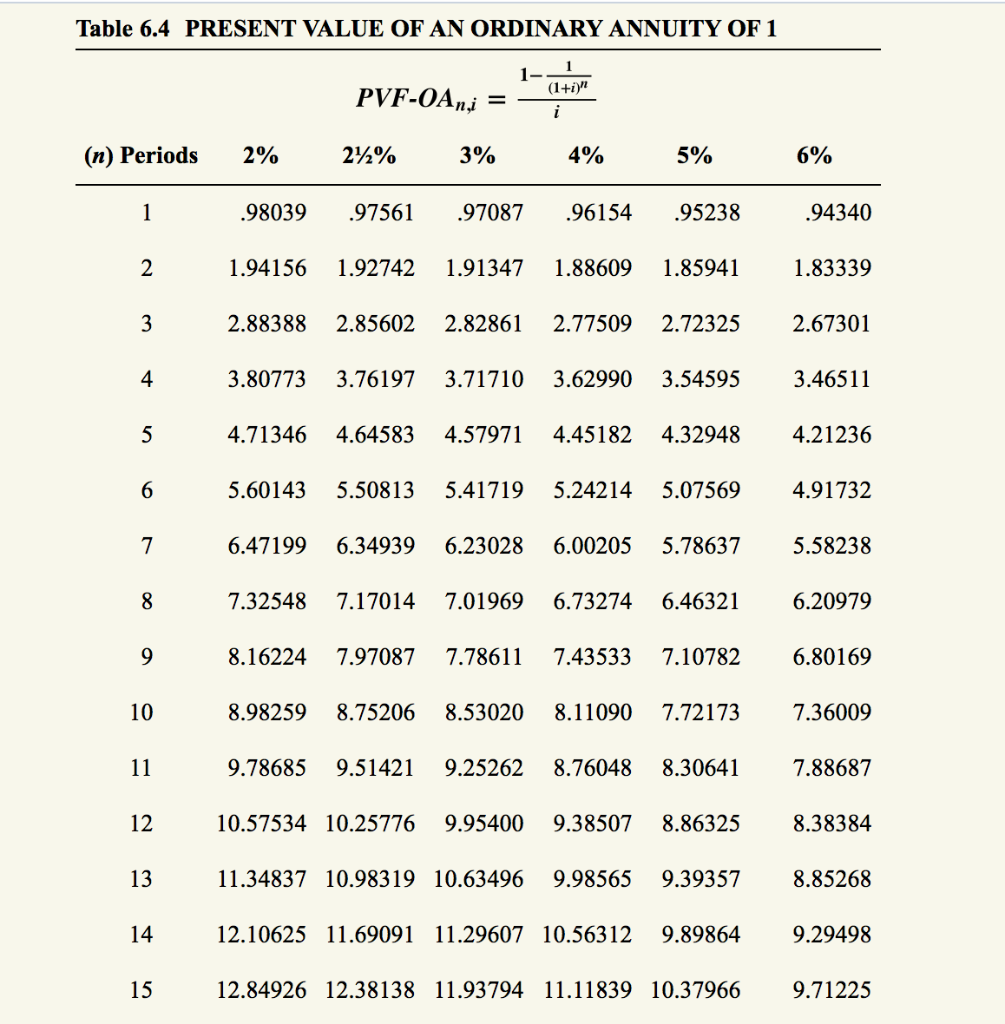

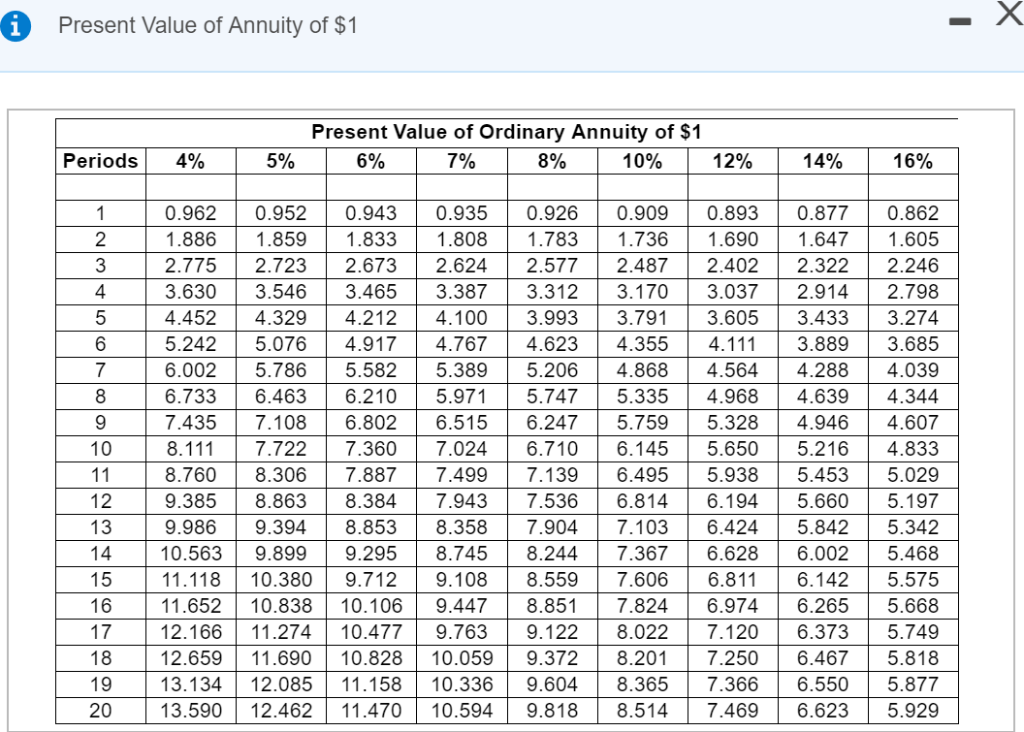

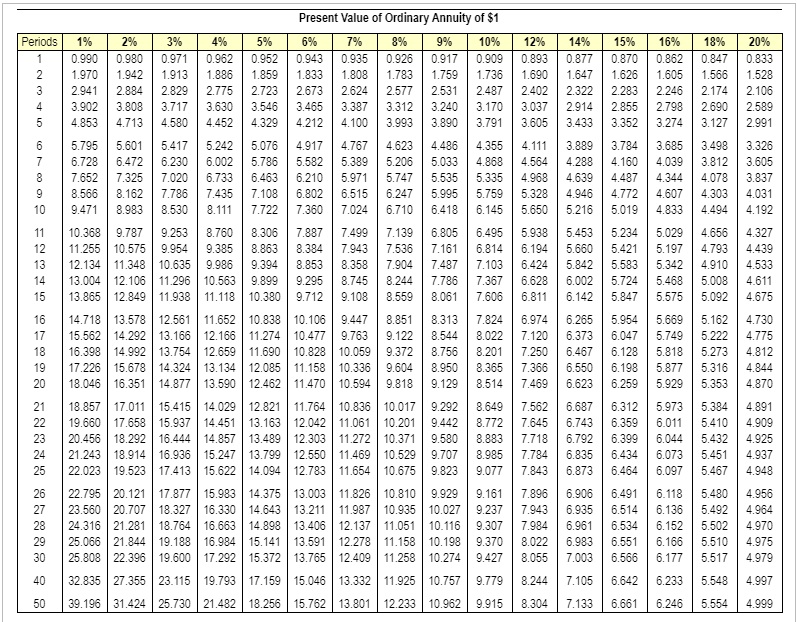

Present Value Of Annuity Due Table 13 Brokeasshome Present value of the annuity (pva) is the present value of any future cash flows (payments). in the section labeled growth rate and additional information, you can reach the following specifications: growth rate of the annuity (g) is the percentage increase of the annuity in the case of a growing annuity. The present value of an annuity formula is: pv = pmt x (1 1 (1 i)n) i. as can be seen present value annuity tables can be used to provide a solution for the part of the present value of an annuity formula shown in red. additionally this is sometimes referred to as the present value annuity factor. pv = pmt x present value annuity factor.

Annuity Present Value Table Brokeasshome Present value of an annuity due (pvad) otherwise t = 1 and the equation reduces to the formula for present value of an annuity due. p v a d = $ 1 i [1 − 1 (1 i) n] (1 i) you can then look up the present value interest factor in the table and use this value as a factor in calculating the present value of an annuity, series of payments. Present value of an annuity with continuous compounding. p v = p m t (e r − 1) [1 − 1 e r t] (1 (e r − 1) t) if type is ordinary annuity, t = 0 and we get the present value of an ordinary annuity with continuous compounding. p v = p m t (e r − 1) [1 − 1 e r t] otherwise type is annuity due, t = 1 and we get the present value of an. The present value of annuity calculator applies a time value of money formula used for measuring the current value of a stream of equal payments at the end of future periods. this is also called discounting. the present value of a future cash flow represents the amount of money today, which, if invested at a particular interest rate, will grow. In this example, pmt= $1,000. r = 10%, represented as 0.10. n = 5 (one payment each year for five years) therefore, the present value of five $1,000 structured settlement payments is worth roughly $3,790.75 when a 10% discount rate is applied. if you simply subtract 10% from $5,000, you would expect to receive $4,500.

Present Value Of An Ordinary Annuity Due 1 Table Brokeasshome The present value of annuity calculator applies a time value of money formula used for measuring the current value of a stream of equal payments at the end of future periods. this is also called discounting. the present value of a future cash flow represents the amount of money today, which, if invested at a particular interest rate, will grow. In this example, pmt= $1,000. r = 10%, represented as 0.10. n = 5 (one payment each year for five years) therefore, the present value of five $1,000 structured settlement payments is worth roughly $3,790.75 when a 10% discount rate is applied. if you simply subtract 10% from $5,000, you would expect to receive $4,500. This amount is $13,420.16, determined as follows: present value of an annuity = factor x amount of the annuity. = 6.71008 x $2,000. = $13,420.16. another way to interpret this problem is to say that, if you want to earn 8%, it makes no difference whether you keep $13,420.16 today or receive $2,000 a year for 10 years. Present value of annuity (pv) = Σ a ÷ (1 r) ^ t. where: pv = present value. a = annuity payment per period ($) t = number of periods. r = yield to maturity (ytm) alternatively, a simpler approach consists of the following two steps: first, the annuity payment is divided by the yield to maturity (ytm), denoted as “r” in the formula.

Annuity Present Value Factor Table Brokeasshome This amount is $13,420.16, determined as follows: present value of an annuity = factor x amount of the annuity. = 6.71008 x $2,000. = $13,420.16. another way to interpret this problem is to say that, if you want to earn 8%, it makes no difference whether you keep $13,420.16 today or receive $2,000 a year for 10 years. Present value of annuity (pv) = Σ a ÷ (1 r) ^ t. where: pv = present value. a = annuity payment per period ($) t = number of periods. r = yield to maturity (ytm) alternatively, a simpler approach consists of the following two steps: first, the annuity payment is divided by the yield to maturity (ytm), denoted as “r” in the formula.

Annuity Present Value Table Pdf Brokeasshome

Comments are closed.