Ppt Spotting Loan Scams Key Warning Signs To Protect Yourself My Payday Loans Onl

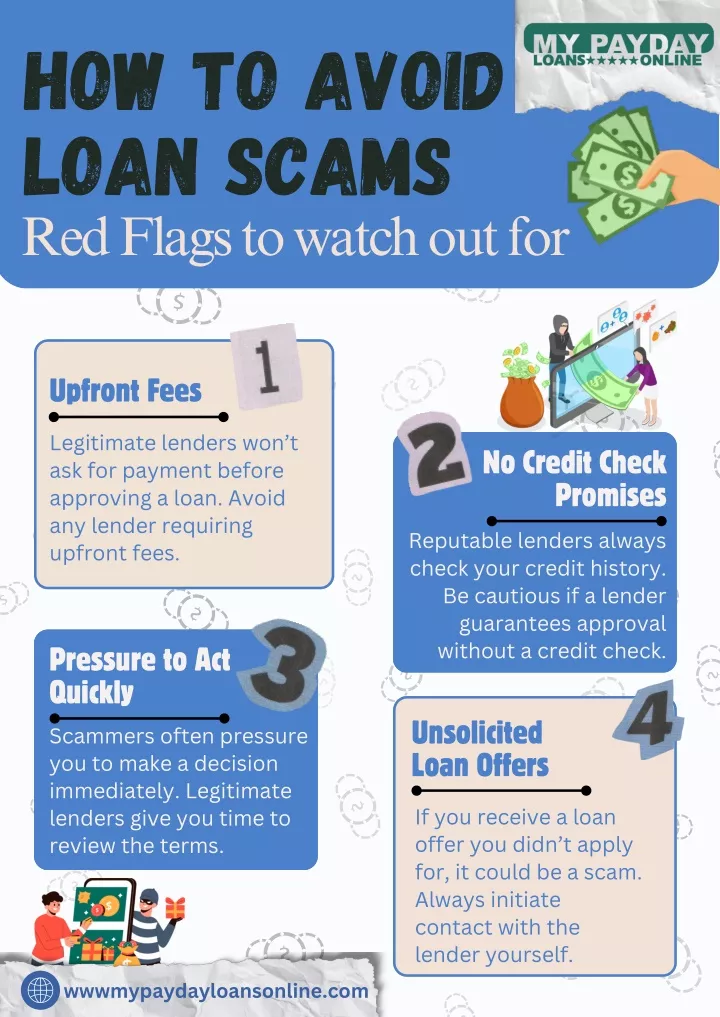

Ppt Spotting Loan Scams Key Warning Signs To Protect Yourself My Payday Loans Onl Protect yourself from common loan scams with my payday loans online. learn how to identify red flags, from upfront fees to high pressure tactics, and keep your finances secure with our expert advice. stay informed and apply for safe loans confidently! slideshow 13680380 by mypaydayloansonline. 1. unrealistic guarantees for approval. one of the most obvious signs of a loan scam is the promise of guaranteed approval. legitimate lenders require a thorough review of your financial details.

Ppt Spotting Loan Scams Key Warning Signs To Protect Yourself My Payday Loans Onl Here are 12 warning signs to look out for. 1. phone offers. if you receive a phone call offering you a guaranteed personal loan or unusually low interest rate, it’s most likely a scam. reputable lenders do not cold call potential customers. it is illegal, in fact, to make loan offers over the phone. The criminals behind personal loan scams can be surprisingly persuasive, and many people fall into the trap. the good news is that once you know the signs of a scammer, you can protect yourself before it’s too late. here are some of the most common types of personal loan scams and some strategies you can use to avoid them. 5. the lender calls you with an offer. a reputable personal loan lender generally doesn’t advertise their services by cold calling consumers and making them a loan offer on the spot. whenever a lender reaches out to you first, this can be a sign of a scammer trying to gain access to your personal banking information. The scammer contacts you. a person impersonating a legitimate loan provider contacts you by phone, email, or text message. at this point, the scammer pitches a personal loan offer to you. the goal of the loan offer is to hook you into the scam. the scammer will use a sense of urgency, so you fall for the scam.

Pin On Peer Finance Money Tips Personal Finance 5. the lender calls you with an offer. a reputable personal loan lender generally doesn’t advertise their services by cold calling consumers and making them a loan offer on the spot. whenever a lender reaches out to you first, this can be a sign of a scammer trying to gain access to your personal banking information. The scammer contacts you. a person impersonating a legitimate loan provider contacts you by phone, email, or text message. at this point, the scammer pitches a personal loan offer to you. the goal of the loan offer is to hook you into the scam. the scammer will use a sense of urgency, so you fall for the scam. Here are some important trends and statistics relating to loan fraud in the us: loan fraud (business personal) was the 5th most common type of identity theft in 2023. in 2023, mortgage fraud risk was highest in ny, fl, ct, ca, and nj. the auto industry experienced a 98% increase in synthetic identity fraud attempts in 2023. Combat a loan scammer by following these steps: compile documentation of the scam. as soon as you suspect a loan scam, assemble copies of emails, loan documents and voicemail recordings from the.

Ppt 7 Key Warning Signs To Protect Yourself From Rental Scams In The Digital Era Powerpoint Here are some important trends and statistics relating to loan fraud in the us: loan fraud (business personal) was the 5th most common type of identity theft in 2023. in 2023, mortgage fraud risk was highest in ny, fl, ct, ca, and nj. the auto industry experienced a 98% increase in synthetic identity fraud attempts in 2023. Combat a loan scammer by following these steps: compile documentation of the scam. as soon as you suspect a loan scam, assemble copies of emails, loan documents and voicemail recordings from the.

Pin On Peer Finance Money Tips Personal Finance

Comments are closed.