Pay Scale Chart India Salary Breakdown Meaning

Pay Scale Chart India Salary Breakdown Meaning A payslip or salary slip is a document provided by the employer to all the employees. it is a monthly statement that consists of the details about all the components of the salary. all elements of the salary breakup, including the deductions, are enlisted in a payslip or a salary slip. it provides the detailed structure of the salary at a glance. Step 4: calculate net salary. net salary is found by subtracting income tax and employer’s pf contribution from the sum of basic salary, actual hra, and special allowance. this is the amount an employee receives in their bank account. net salary= basic salary actual hra special allowance – income tax – employer’s pf contribution (epf).

Pay Scale Chart India Salary Breakdown Meaning Take home salary (annual) = inr 13,58,540 take home salary (monthly) = inr 1,13,212. some common queries: 1. when and how much gratuity do you get paid? in india, the basic requirements for gratuity are set out under the payment of gratuity act 1971. Pay structure = basic pay hra overtime pay dearness allowance (da) here is, however, a detailed breakdown of the salary components for a better understanding: ctc = gross salary health insurance epf. basic = 40% of ctc amount. da = 55% of basic salary. hra = 50% of basic salary in metro city. health insurance. It is a payment structure that comprises different components of the total compensation package that a company offers to an employee. the company uses a salary structure to determine how much salary it is required to pay the employee. a salary structure may have pay grades with minimum, middle and maximum salary ranges. You can calculate an employee’s salary in three easy steps: 1) enter the annual ctc amount for a specific employee. 2) select compliance settings as per your organization’s applicability. 3) while you are there, you can view the salary structure according to the details provided by you.

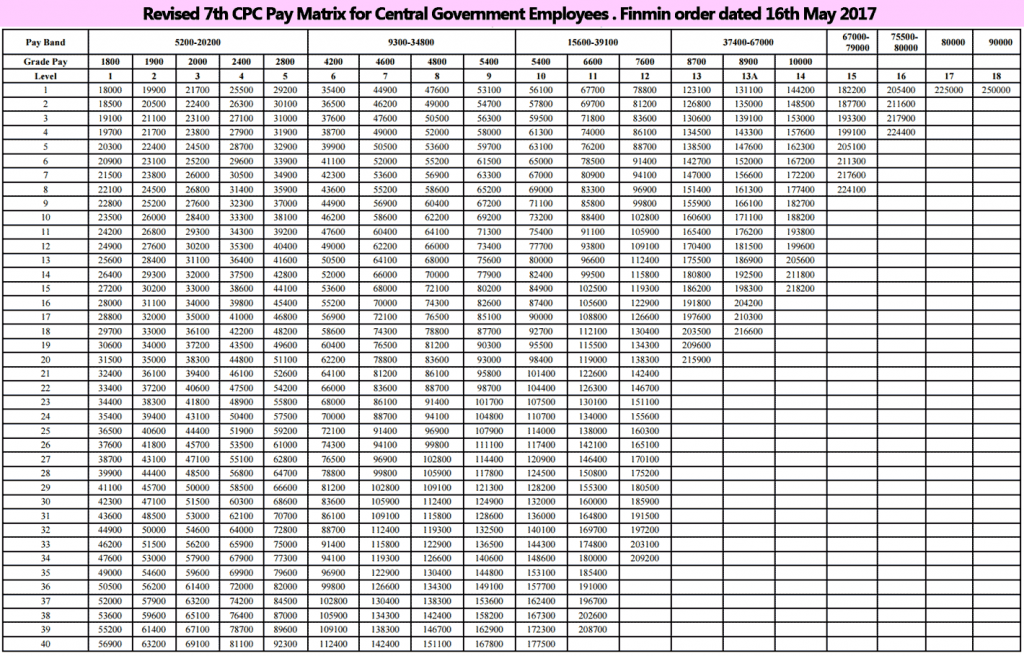

Pay Scale Chart India Salary Breakdown Meaning It is a payment structure that comprises different components of the total compensation package that a company offers to an employee. the company uses a salary structure to determine how much salary it is required to pay the employee. a salary structure may have pay grades with minimum, middle and maximum salary ranges. You can calculate an employee’s salary in three easy steps: 1) enter the annual ctc amount for a specific employee. 2) select compliance settings as per your organization’s applicability. 3) while you are there, you can view the salary structure according to the details provided by you. Top down: in this type, you define the amount for different salary components and add up the total as gross. for example: basic – 5000, da – 5000 = gross – 10000. bottom up: in this type, you define the total gross and then divide the amount between different components. for example, gross = 10000; basic is 40% of gross, da is 60% of gross. The pay matrix has become a crucial concept in understanding the salary structure for indian government employees. introduced by the 7th central pay commission (cpc) in 2016, it replaced the earlier system of pay scales and grade pay with a more streamlined and transparent approach.

Salary Structure In India Different Types And Components Top down: in this type, you define the amount for different salary components and add up the total as gross. for example: basic – 5000, da – 5000 = gross – 10000. bottom up: in this type, you define the total gross and then divide the amount between different components. for example, gross = 10000; basic is 40% of gross, da is 60% of gross. The pay matrix has become a crucial concept in understanding the salary structure for indian government employees. introduced by the 7th central pay commission (cpc) in 2016, it replaced the earlier system of pay scales and grade pay with a more streamlined and transparent approach.

Seventh Pay Commission Pay Scales Chart Pay Matrix 7th Cpc Scale Commission India Levels Seventh

Comments are closed.