June Consumer Spending Rises Despite Inflation

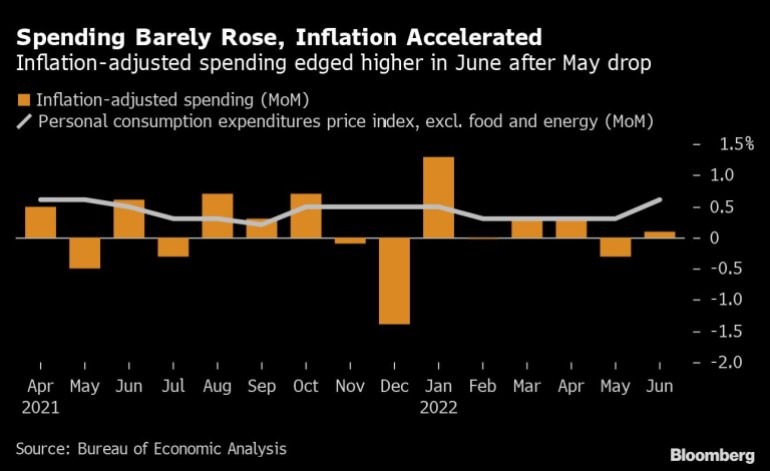

Us Consumers Are Spending More Despite Rising Inflation World Economic Forum U.s. consumer spending increased 1% in june despite high inflation. american consumers increased their spending by 1% in june—a dose of energy for an economy that is quickly rebounding from the. Consumer spending, which accounts for more than two thirds of u.s. economic activity, increased 0.5% in june after gaining 0.2% in may, the commerce department report showed.

Us Consumer Spending Rises In June As Inflation Takes Bigger Bite Business And Economy News Spending by consumers rose by a brisk 0.4% in september the government said friday — even after adjusting for inflation and even as americans face ever higher borrowing costs. economists caution that such vigorous spending isn’t likely to continue in the coming months. many households have been pulling money from a shrinking pool of savings. Last week, the government issued a separate inflation measure — the consumer price index — which showed that prices surged 0.5% from december to january, much more than the previous month’s 0.1% rise. measured year over year, consumer prices climbed 6.4% in january. that was well below a recent peak of 9.1% in june but still far above the. New york (ap) — americans increased their spending last month as inflation eased in many areas, and the job market remained remarkably strong. retail sales rose 0.2% from may to june, following a revised 0.5% increase the previous month, the commerce department reported tuesday. the figure matched the pace of consumer inflation in june from. In the second quarter of 2024, us consumer optimism fell, mirroring levels seen at the end of 2023. economic pessimism grew slightly, fueled by concerns over inflation, the depletion of personal savings, and perceived weakness in the labor market. these concerns left consumers somewhat conflicted: on one hand, they continued to splurge on food.

Comments are closed.