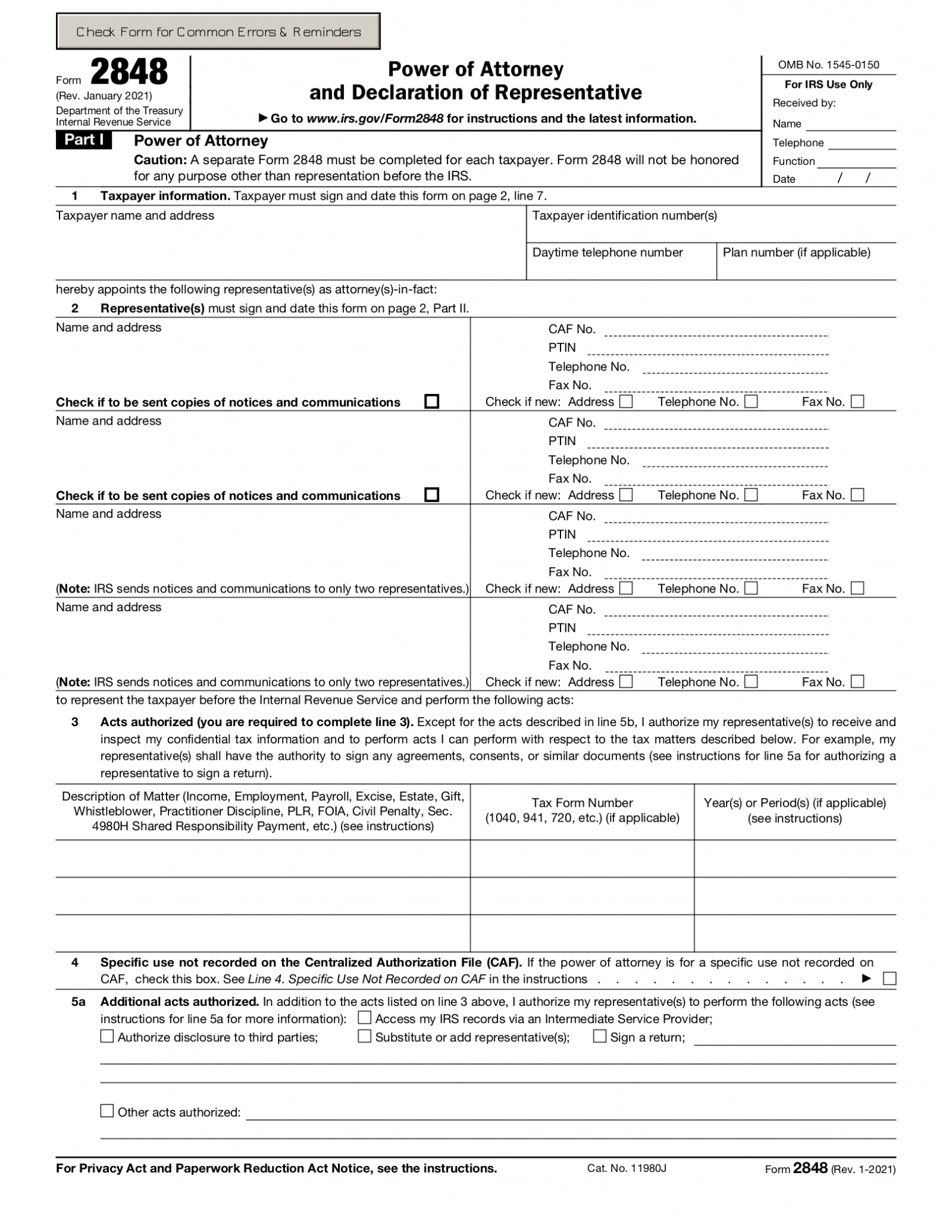

Irs Power Of Attorney

Free Irs Power Of Attorney Form 2848 Revised Jan 2021 Pdf Eforms Learn how to use form 2848 to appoint a person eligible to practice before the irs to represent you. find out the requirements, exceptions, and online submission options for this form. Learn about the options and requirements to submit power of attorney (poa) and tax information authorization (tia) to the irs. compare online and offline methods, signatures, processing times, and tax matters or periods.

Where To Fax Irs Power Of Attorney Learn how to grant a third party authorization to help you with federal tax matters. find out the types, purposes, and expiration of power of attorney, tax information authorization, third party designee, and oral disclosure. Learn how to authorize someone to represent you before the irs with form 2848. find out what actions your agent can and cannot take, how to fill out the form, and how to revoke it. Form 2848 is used to give the irs permission to discuss your taxes with someone else, such as a tax professional or a family member. learn who can act as your representative, how to fill out the form, and where to mail or fax it to the irs. Form 2848 authorizes an individual or organization to represent a taxpayer before the irs, such as at an audit. learn who can file, how to fill out, and what actions the representative can take on your behalf.

Comments are closed.