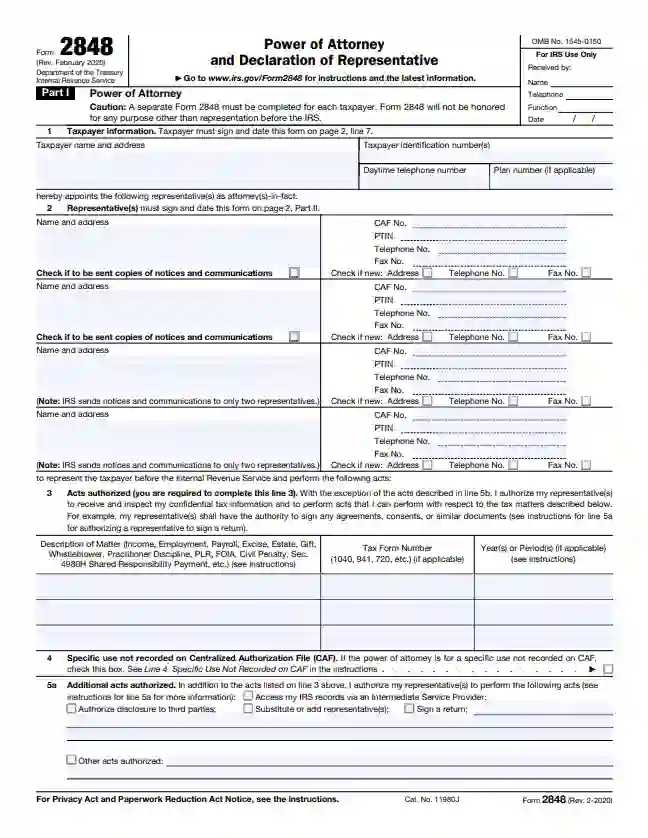

How To Sign As Power Of Attorney Irs

How To Sign As Power Of Attorney Irs This authorization is called power of attorney. with power of attorney, the authorized person can: represent, advocate, negotiate and sign on your behalf, argue facts and the application of law, receive your tax information for the matters and tax years periods you specify, and. receive copies of irs notices and communications if you choose. Submit forms 2848 and 8821 online to the irs. secure form upload. electronic or handwritten signature. first in, first out processing. use for: individual or business taxpayer. any tax matter or period. prior authorizations retained or revoked. submit forms online.

Fillable Irs Power Of Attorney Form 2848 Pdf Irs Poa Check the box on line 5a authorizing your representative to sign your income tax return and include the following statement on the lines provided: "this power of attorney is being filed pursuant to 26 cfr 1.6012 1(a)(5), which requires a power of attorney to be attached to a return if a return is signed by an agent by reason of [enter the. Form 2848 is used when you need someone to handle your tax matters. it grants a representative, such as a cpa, attorney, or enrolled agent, the authority to represent you before the irs. on the. Irs form 2848 authorizes individuals or organizations to represent a taxpayer when appearing before the irs. authorized representatives, include attorneys, cpas, and enrolled agents. signing form. Key takeaways. form 2848, power of attorney, is used to give the irs permission to discuss your taxes with someone else. you can authorize immediate family members or a tax professional to act on your behalf. you must provide specific information on line 3 of part i to define the scope of authority you wish to give your representative.

Comments are closed.