How To Calculate Future Value Rate Haiper

How To Calculate Future Value Equation Haiper We can ignore pmt for simplicity's sake. pressing calculate will result in an fv of $10.60. this means that $10 in a savings account today will be worth $10.60 one year later. the time value of money. fv (along with pv, i y, n, and pmt) is an important element in the time value of money, which forms the backbone of finance. there can be no such. Your input can include complete details about loan amounts, down payments and other variables, or you can add, remove and modify values and parameters using a simple form interface. future value. save $1000 at 3% interest for 25 years. calculate interest pv $700 fv 1000 12 periods compounded monthly. future value with pv = $500 in 10 years.

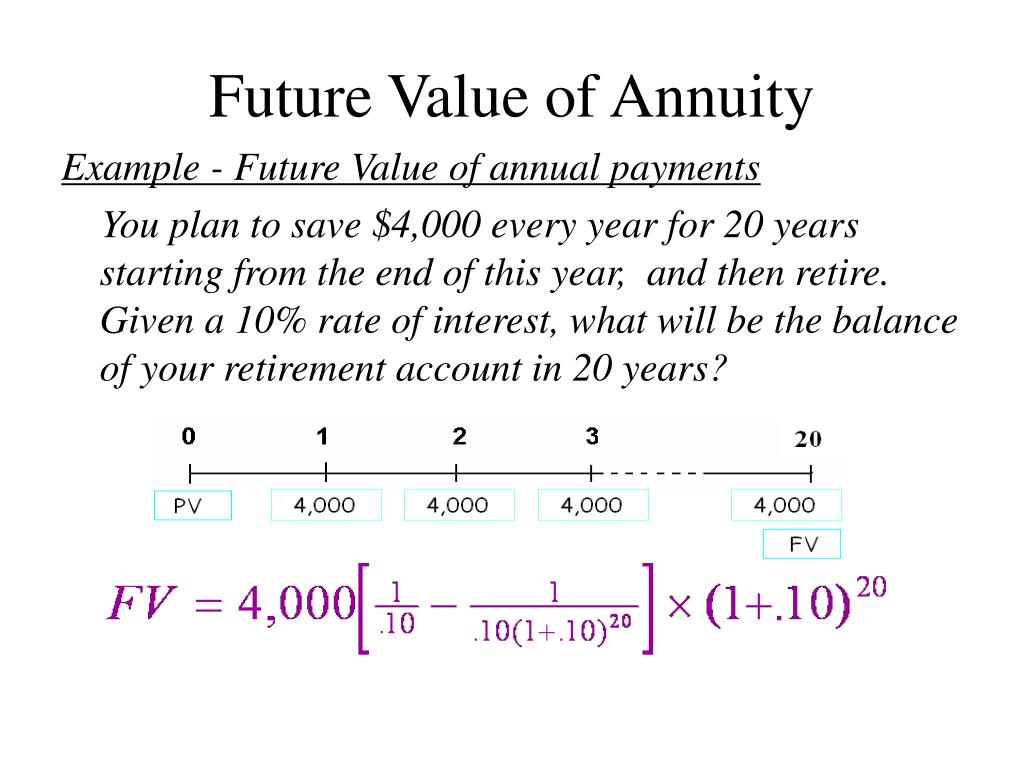

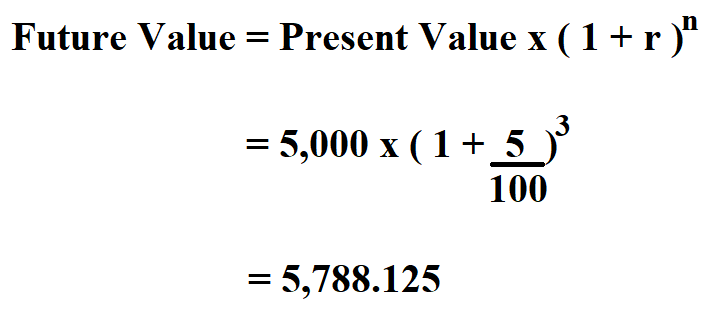

How To Calculate Future Value Rate Haiper The future value formula helps you calculate the future value of an investment (fv) for a series of regular deposits at a set interest rate (r) for a number of years (t). using the formula requires that the regular payments are of the same amount each time, with the resulting value incorporating interest compounded over the term. The future value formula is fv=pv (1 i) n, where the present value pv increases for each period into the future by a factor of 1 i. the future value calculator uses multiple variables in the fv calculation: the present value sum. number of time periods, typically years. The future value formula is fv=pv* (1 r)^n, where pv is the present value of the investment, r is the annual interest rate, and n is the number of years the money is invested. the excel function fv can be used when there is a constant interest rate. Here’s how to do this on a financial calculator: 1. clear the financial calculator. before we start, clear the financial keys by pressing [2nd] and then pressing [fv]. this will set the calculation up for future value. since we have monthly payments, you should do everything in terms of months. 2.

How To Calculate The Future Value Haiper The future value formula is fv=pv* (1 r)^n, where pv is the present value of the investment, r is the annual interest rate, and n is the number of years the money is invested. the excel function fv can be used when there is a constant interest rate. Here’s how to do this on a financial calculator: 1. clear the financial calculator. before we start, clear the financial keys by pressing [2nd] and then pressing [fv]. this will set the calculation up for future value. since we have monthly payments, you should do everything in terms of months. 2. Use the future value (fv) formula: fv = pv⋅ (1 r)n. substitute the known values for present value (pv), annual interest rate (r) and number of years of the investment (n): fv = $1000⋅ (1 0.08)5. perform the corresponding numerical calculations and obtain the future value: fv = $1,469.33. Use this fv calculator to easily calculate the future value (fv) of an investment of any kind. a versatile tool allowing for period additions or withdrawals (cash inflows and outflows), a.k.a. future value with payments. computes the future value of annuity by default, but other options are available. initial value.

Comments are closed.