How To Calculate Future Value Fv Of Ordinary Annuity Using Ms Excel

Future Value Of An Ordinary Annuity In Excel Youtube An annuity due is a repeating payment made at the beginning of each period, instead of at the end of each period. to calculate an annuity due with the fv function, set the type argument to 1: = fv (c5,c6, c4,0,1) with type set to 1, fv returns $338,382.35. to get the present value of an annuity, you can use the fv function. Method 1 – using the fv function to get the future value of an annuity. the fv function returns the future value of an investment. to get the value, we need to input the interest rate, the number of periods to pay the installments, and the fixed payment amount. we’ll find the future value for both annuity types.

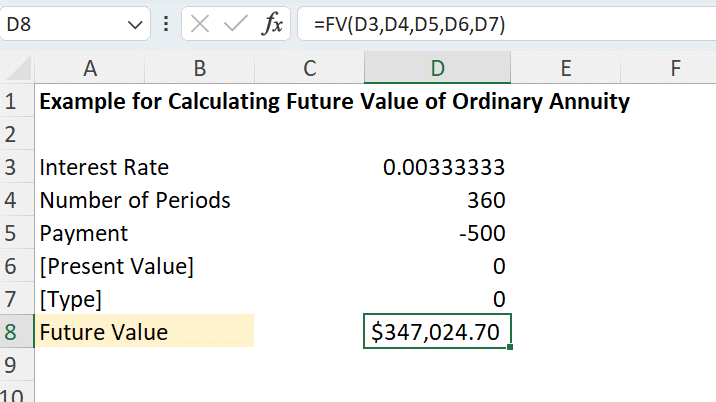

How To Calculate Future Value Fv Of Ordinary Annuity Using Ms Excel Youtube Step 2) for the rate argument, refer to the interest rate. step 3) for the nper argument, refer to the number of years. step 4) for the nper argument, refer to the periodic payments to be made. step 5) omit the pv and type argument. step 6) and hit enter. excel returns the fv of this annuity as $256,611.41. To find the future value, configure the fv function in this way: =fv(c2, c3, c4) please notice that pmt is a negative number because this money is paid out. if the payment is represented by a positive number, don't forget to put the minus sign right before the pmt argument: =fv(c2, c3, c4) how to calculate future value in excel formula examples. The future value of an ordinary annuity is the value of a series of equal payments at the end of each period, compounded at a certain rate. the formula for calculating the future value (fv) of an ordinary annuity is given by: where: is the periodic payment, is the interest rate per period, and; is the number of periods. procedures in excel. Steps: select a cell (c9) where you want to calculate the annuity payment, the future value. enter the corresponding formula in the c9 cell: =fv(c6,c7,c5) press enter to get the future value. formula breakdown. here, the fv function will return a future value of the periodic investment.

Future Value Of Annuity Excel Formula Exceljet The future value of an ordinary annuity is the value of a series of equal payments at the end of each period, compounded at a certain rate. the formula for calculating the future value (fv) of an ordinary annuity is given by: where: is the periodic payment, is the interest rate per period, and; is the number of periods. procedures in excel. Steps: select a cell (c9) where you want to calculate the annuity payment, the future value. enter the corresponding formula in the c9 cell: =fv(c6,c7,c5) press enter to get the future value. formula breakdown. here, the fv function will return a future value of the periodic investment. Example for calculating future value of ordinary annuity in excel – 1. to calculate the future value of this annuity, you can simply type “=fv” in the cell where you want the result. then, select the rate, nper, pmt, [pv] (if applicable), and [type] (if applicable) in this function. press enter, and excel will immediately return the. Ordinary annuities and annuities due differ in the timing of those recurring payments. the future value of an annuity is the total value of payments at a future point in time. the present value is.

How To Calculate Future Value Of Annuity In Excel Example for calculating future value of ordinary annuity in excel – 1. to calculate the future value of this annuity, you can simply type “=fv” in the cell where you want the result. then, select the rate, nper, pmt, [pv] (if applicable), and [type] (if applicable) in this function. press enter, and excel will immediately return the. Ordinary annuities and annuities due differ in the timing of those recurring payments. the future value of an annuity is the total value of payments at a future point in time. the present value is.

Learn Future Value Function In Excel Ordinary Annuity Youtube

Comments are closed.