How To Calculate Annuity Factor

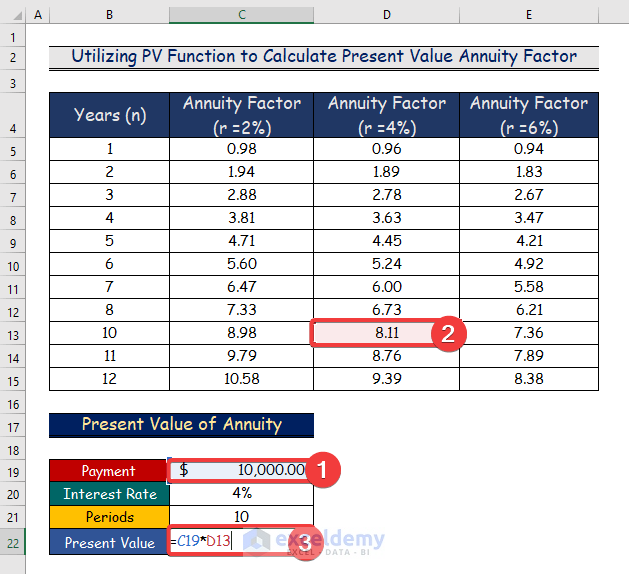

How To Calculate Annuity Factor In Excel 2 Ways Exceldemy For example, an individual is wanting to calculate the present value of a series of $500 annual payments for 5 years based on a 5% rate. by looking at a present value annuity factor table, the annuity factor for 5 years and 5% rate is 4.3295. this is the present value per dollar received per year for 5 years at 5%. Ordinary annuities and annuities due differ in the timing of those recurring payments. the future value of an annuity is the total value of payments at a future point in time. the present value is.

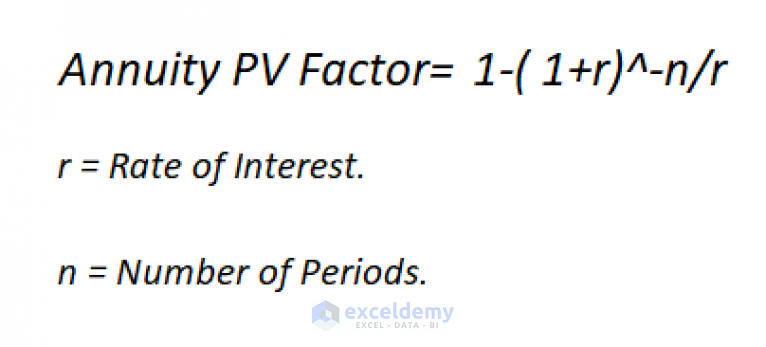

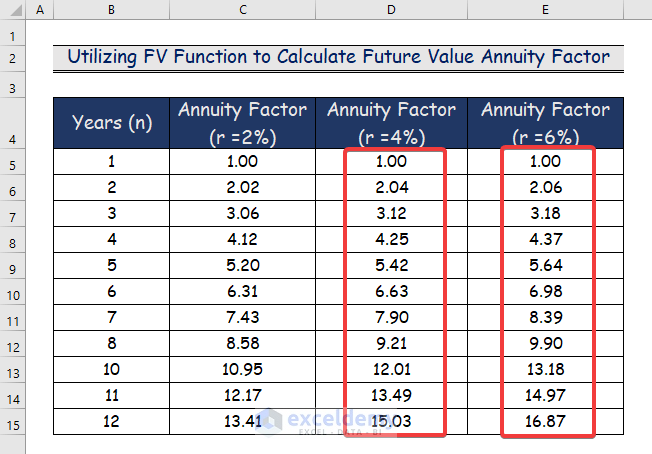

How To Calculate Annuity Factor In Excel 2 Ways Exceldemy The discount rate is a key factor in calculating the present value of an annuity. the discount rate is an assumed rate of return or interest rate that is used to determine the present value of. The present value of an annuity is the total value of all of future annuity payments. a key factor in determining the present value of an annuity is the discount rate. you can calculate the. There are two methods to calculate the annuity factor. the methods are similar but have slight variations. method 1. annuity factor, af = here, 'n' is the number of years, and 'r' is the interest rate. method 2. the annuity factor can also be calculated as the sum of individual discount factors. the discount factor for year 1: (1 r) 1. An annuity factor is a multiplier used to determine how much money will be paid out in the annuity contract. here is how to calculate it and what you should know.

Annuity Formula Calculation Examples With Excel Template There are two methods to calculate the annuity factor. the methods are similar but have slight variations. method 1. annuity factor, af = here, 'n' is the number of years, and 'r' is the interest rate. method 2. the annuity factor can also be calculated as the sum of individual discount factors. the discount factor for year 1: (1 r) 1. An annuity factor is a multiplier used to determine how much money will be paid out in the annuity contract. here is how to calculate it and what you should know. Learn how to use the annuity factor method to determine how much money you can withdraw from your retirement accounts without paying penalties. find out the factors, resources, and other methods to apply this calculation. Growth rate of the annuity (g) is the percentage increase of the annuity in the case of a growing annuity. number of periods (t) shows the annuity term in years. equivalent interest rate and periodic equivalent interest rate are the interest rates computed when the payments and compoundings occur with a different frequency (cannot be set manually).

How To Calculate Annuity Factor In Excel 2 Ways Exceldemy Learn how to use the annuity factor method to determine how much money you can withdraw from your retirement accounts without paying penalties. find out the factors, resources, and other methods to apply this calculation. Growth rate of the annuity (g) is the percentage increase of the annuity in the case of a growing annuity. number of periods (t) shows the annuity term in years. equivalent interest rate and periodic equivalent interest rate are the interest rates computed when the payments and compoundings occur with a different frequency (cannot be set manually).

Present Value Annuity Factor Formula With Calculator

Comments are closed.