How To Calculate Annuities Using Excel Present Value Of Annuity For Asset Valuation

Calculating The Present Value Of Annuities In Excel A Step By Step Guide In this video, we will teach you how to calculate annuities in excel.annuities means a series of payments, or equal cashflow at equal time intervals. you can. With an annuity due, payments are made at the beginning of the period, instead of the end. to calculate present value for an annuity due, use 1 for the type argument. in the example shown, the formula in f9 is: = pv (f7,f8, f6,0,1) note the inputs (which come from column f) are the same as the original formula. the only difference is type = 1.

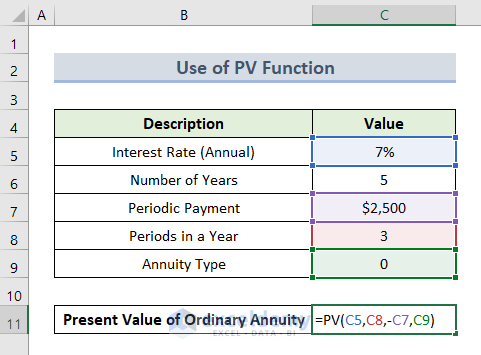

How To Calculate Annuities Using Excel Present Value Of Annuity For Asset Valuation Calculating the present value of an annuity using microsoft excel is a fairly straightforward exercise, as long as you know a given annuity's interest rate, payment amount, and duration. but it's. Step 2) for the rate argument, refer to the interest rate. step 3) for the nper argument, refer to the number of years. step 4) for the nper argument, refer to the periodic payments to be made. step 5) omit the pv and type argument. step 6) and hit enter. excel returns the fv of this annuity as $256,611.41. This function returns the present value of an annuity, loan or investment based on a constant interest rate. again, we will determine present value for both ordinary annuity and annuity due types. 2.1 – present value of an ordinary annuity. to calculate the present value of an ordinary annuity: in cell c11, insert the formula below:. Ordinary annuities and annuities due differ in the timing of those recurring payments. the future value of an annuity is the total value of payments at a future point in time. the present value is.

Excel Formulas To Calculate The Periods For Annuity Useful Guide This function returns the present value of an annuity, loan or investment based on a constant interest rate. again, we will determine present value for both ordinary annuity and annuity due types. 2.1 – present value of an ordinary annuity. to calculate the present value of an ordinary annuity: in cell c11, insert the formula below:. Ordinary annuities and annuities due differ in the timing of those recurring payments. the future value of an annuity is the total value of payments at a future point in time. the present value is. The present value calculator formula in b9 is: =pv(b2 b7, b3*b7, b4, b5, b6) assuming you make a series of $500 payments at the beginning of each quarter for 3 years with a 7% annual interest rate, set up the source data as shown in the image below. and the present value calculator will output the result:. Key takeaways. present value (pv) is the current value of a stream of future cash flows. pv analysis is used to value a range of assets, from stocks and bonds to real estate and annuities. pv can.

How To Apply Present Value Of Annuity Formula In Excel The present value calculator formula in b9 is: =pv(b2 b7, b3*b7, b4, b5, b6) assuming you make a series of $500 payments at the beginning of each quarter for 3 years with a 7% annual interest rate, set up the source data as shown in the image below. and the present value calculator will output the result:. Key takeaways. present value (pv) is the current value of a stream of future cash flows. pv analysis is used to value a range of assets, from stocks and bonds to real estate and annuities. pv can.

Comments are closed.