Growth Vs Value Investing

Growth Vs Value Stocks Investing Styles The Motley Fool The decision to invest in growth vs. value stocks is ultimately left to an individual investor’s preference, as well as their personal risk tolerance, investment goals, and time horizon. it. Investing is often categorized into two fundamental styles: value vs. growth. here are the differences between value and growth stocks.

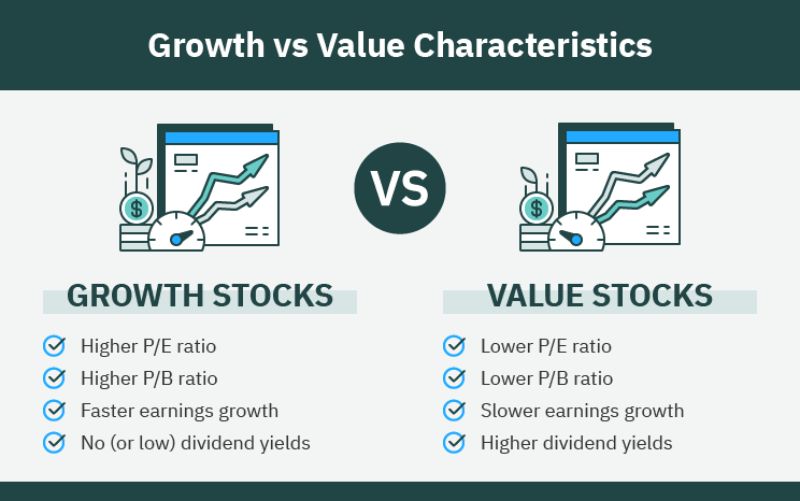

Value Vs Growth Investing Which Should You Buy Learn the differences between growth and value investing styles, and how to use them to diversify your portfolio. find out how to use fidelity's stylemaps to choose funds based on size and style categories. Learn the differences and advantages of value and growth investing styles, and how they perform in different economic climates. see examples of famous investors and stocks that fit each category, and how to balance them in your portfolio. There is an alternative investing strategy that blends aspects of both growth and value investing known as growth at a reasonable price, or garp. famed investor peter lynch popularized the strategy. Growth investing vs. value investing. where growth investing seeks out companies that are growing their revenue, profits or cash flow at a faster than average pace, value investing targets older.

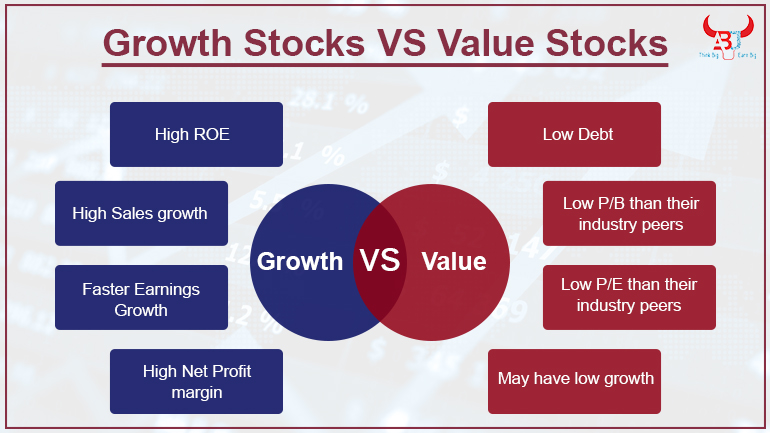

Value Investing Vs Growth Investing Which Is Better There is an alternative investing strategy that blends aspects of both growth and value investing known as growth at a reasonable price, or garp. famed investor peter lynch popularized the strategy. Growth investing vs. value investing. where growth investing seeks out companies that are growing their revenue, profits or cash flow at a faster than average pace, value investing targets older. Learn the differences between growth and value stocks, and how to choose the best investing style for your goals and preferences. compare growth and value indexes, and see examples of each type of stock. Growth and value are two fundamental approaches, or styles, in stock and stock mutual fund investing. footnote 1 growth investors seek companies that offer strong earnings growth while value investors seek stocks that appear to be undervalued in the marketplace. because the two styles complement each other, they can help add diversity to your.

Comments are closed.