Future Value Of Annuity Due Formula Calculator Excel Template

Annuity Due Formula Example With Excel Template An annuity due is a repeating payment made at the beginning of each period, instead of at the end of each period. to calculate an annuity due with the fv function, set the type argument to 1: = fv (c5,c6, c4,0,1) with type set to 1, fv returns $338,382.35. to get the present value of an annuity, you can use the fv function. This has been a guide to the future value of annuity due formula. here we discuss how to calculate the future value of annuity due along with practical examples. we also provide the future value of annuity due calculator with a downloadable excel template. you may also look at the following articles to learn more –.

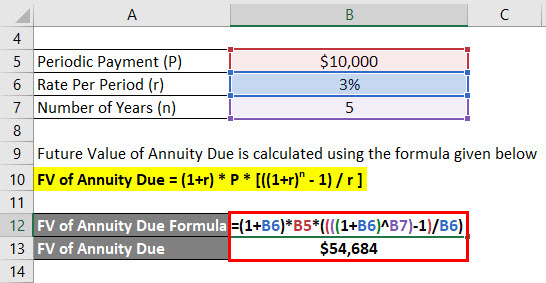

Future Value Of Annuity Due Formula Calculator Excel Template Step 2) for the rate argument, refer to the interest rate. step 3) for the nper argument, refer to the number of years. step 4) for the nper argument, refer to the periodic payments to be made. step 5) omit the pv and type argument. step 6) and hit enter. excel returns the fv of this annuity as $256,611.41. 1.2 – annuity due. now we’ll find out the future value of the annuity due. steps: select cell c9. enter the following formula: =fv(c6,c7, c5,0,1) return the result by pressing enter. the accurate annuity due value is returned. read more: how to calculate future value in excel with different payments. Future value of annuity due = 600 * ((1 6%) 10 – 1) * (1 6%)) 6%; future value of annuity due = $8,382.99; annuity due formula – example #2. let us look at an example of calculation of present and future value of an annuity due using the excel formula. mr. a is a salaried individual and receives his salary at the end of each month. If you choose to invest money as a one time lump sum payment, the future value formula is based on the present value (pv) rather than periodic payment (pmt). so, we set up our sample data as follows: annual interest rate (c2): 7%; no. of years (c3): 5; present value (c4): 1000; the formula to calculate the future value of the investment is:.

Future Value Of Annuity Due Formula Calculator Excel Template Future value of annuity due = 600 * ((1 6%) 10 – 1) * (1 6%)) 6%; future value of annuity due = $8,382.99; annuity due formula – example #2. let us look at an example of calculation of present and future value of an annuity due using the excel formula. mr. a is a salaried individual and receives his salary at the end of each month. If you choose to invest money as a one time lump sum payment, the future value formula is based on the present value (pv) rather than periodic payment (pmt). so, we set up our sample data as follows: annual interest rate (c2): 7%; no. of years (c3): 5; present value (c4): 1000; the formula to calculate the future value of the investment is:. This open access excel template is a useful tool for bankers, investment professionals, corporate finance practitioners, and portfolio managers. present value of annuity due is among the topics included in the quantitative methods module of the cfa level 1 curriculum. gain valuable insights into the subject with our math for finance course. You can use the template to calculate the future value of a series of expected annuity payments, paid at the beginning of the period. this open access excel template is a useful tool for bankers, investment professionals, corporate finance practitioners, and portfolio managers. future value of annuity due is among the topics included in the.

Annuity Formula Calculation Examples With Excel Template This open access excel template is a useful tool for bankers, investment professionals, corporate finance practitioners, and portfolio managers. present value of annuity due is among the topics included in the quantitative methods module of the cfa level 1 curriculum. gain valuable insights into the subject with our math for finance course. You can use the template to calculate the future value of a series of expected annuity payments, paid at the beginning of the period. this open access excel template is a useful tool for bankers, investment professionals, corporate finance practitioners, and portfolio managers. future value of annuity due is among the topics included in the.

Future Value Of Annuity Due Formula Calculator Excel Template

Comments are closed.