Future Value Of An Ordinary Annuity Annuity Due Youtube

Future Value Of An Annuity Due Youtube This finance video tutorial explains how to calculate the future value of an annuity due using a formula and using a step by step process. the future value. This finance video tutorial explains how to calculate the future value of an ordinary annuity using a formula. you need to know the amount of money being de.

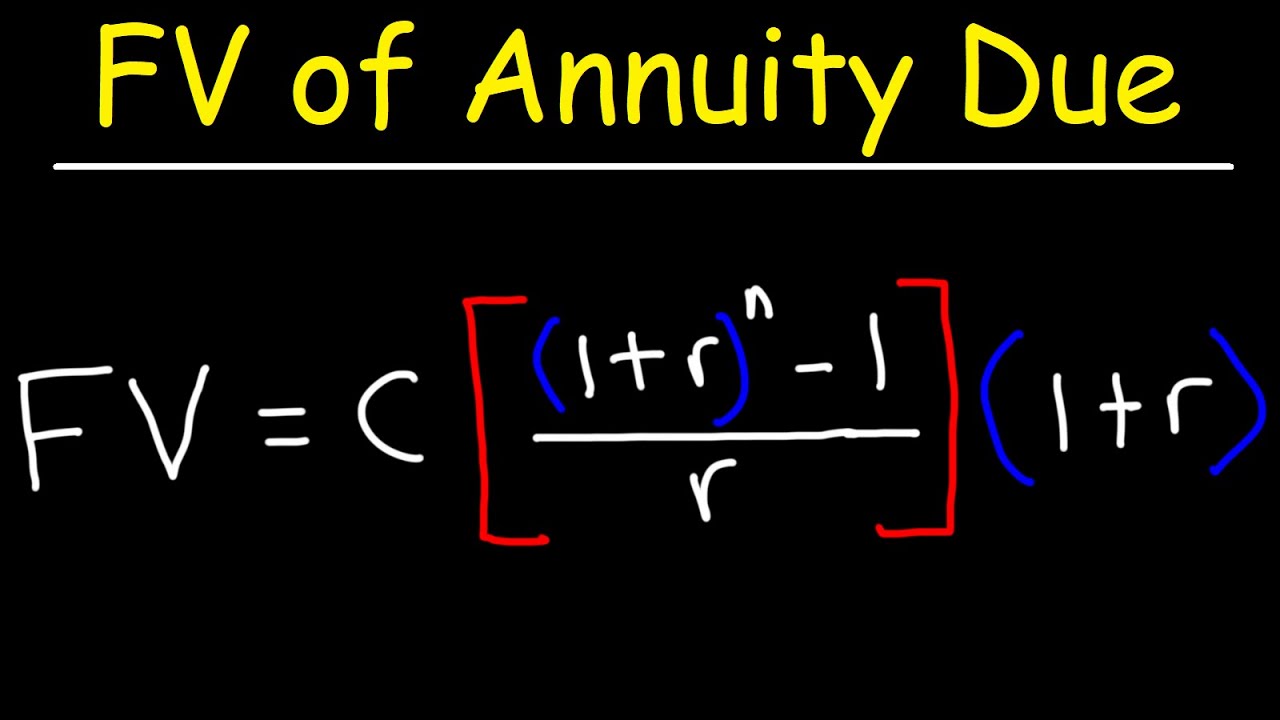

Future Value Of An Ordinary Annuity Annuity Due Youtube Calculate present value, future value for both ordinary and annuity due type annuities, knowing the equal payments, interest rate, and time frame calculate t. The takeaway is that an annuity due will have a higher present value vs. an ordinary annuity if all other factors are the same. related investing topics how to invest money: a step by step guide. F v = p m t e r − 1 [e r t − 1] (1 (e r − 1) t) if type is ordinary annuity, t = 0 and we get the future value of an ordinary annuity with continuous compounding. f v = p m t e r − 1 [e r t − 1] otherwise type is annuity due, t = 1 and we get the future value of an annuity due with continuous compounding. f v = p m t e r − 1 [e r. To calculate the future value of an annuity: define the periodic payment you will do (p), the return rate per period (r), and the number of periods you are going to contribute (n). calculate: (1 r)ⁿ minus one and divide by r. multiply the result by p, and you will have the future value of an annuity.

8 Of 26 Ch 6 Annuity Ordinary Vs Due Future Value Youtube F v = p m t e r − 1 [e r t − 1] (1 (e r − 1) t) if type is ordinary annuity, t = 0 and we get the future value of an ordinary annuity with continuous compounding. f v = p m t e r − 1 [e r t − 1] otherwise type is annuity due, t = 1 and we get the future value of an annuity due with continuous compounding. f v = p m t e r − 1 [e r. To calculate the future value of an annuity: define the periodic payment you will do (p), the return rate per period (r), and the number of periods you are going to contribute (n). calculate: (1 r)ⁿ minus one and divide by r. multiply the result by p, and you will have the future value of an annuity. Ordinary annuities and annuities due differ in the timing of those recurring payments. the future value of an annuity is the total value of payments at a future point in time. the present value is. Fv ord = future value of an ordinary annuity pmt = payment amount i = interest rate n = number of payments the formula above is for an “ordinary annuity,” which is an annuity that involves making payments at the end of each payment period. this makes quite a bit of difference in an annuity’s perceived value, due to the time value of money.

Annuities How To Calculate The Future Value Of An Annuity Due Youtube Ordinary annuities and annuities due differ in the timing of those recurring payments. the future value of an annuity is the total value of payments at a future point in time. the present value is. Fv ord = future value of an ordinary annuity pmt = payment amount i = interest rate n = number of payments the formula above is for an “ordinary annuity,” which is an annuity that involves making payments at the end of each payment period. this makes quite a bit of difference in an annuity’s perceived value, due to the time value of money.

Annuity Ordinary And Annuity Due Present Future Value Financial Management Ch 3 Part

Comments are closed.