Future Value Of An Annuity Formula Example And Excel Template

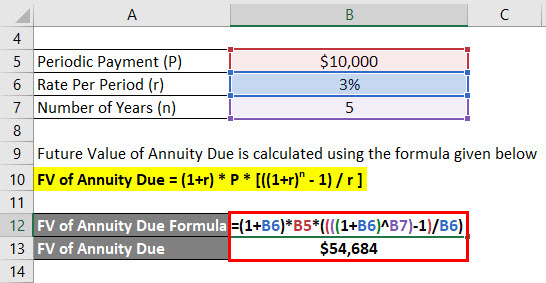

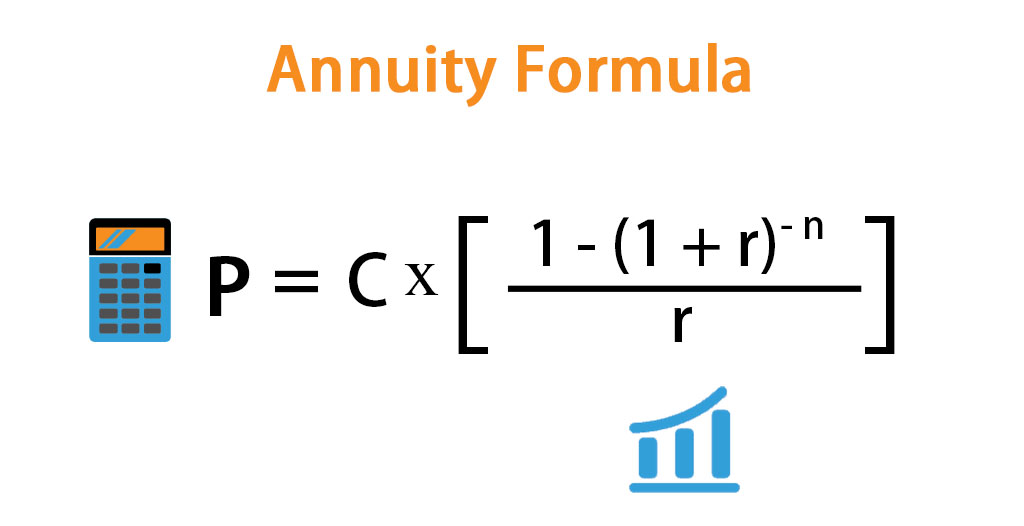

Future Value Of Annuity Due Formula Calculator Excel Template An annuity due is a repeating payment made at the beginning of each period, instead of at the end of each period. to calculate an annuity due with the fv function, set the type argument to 1: = fv (c5,c6, c4,0,1) with type set to 1, fv returns $338,382.35. to get the present value of an annuity, you can use the fv function. Explanation. the formula for future value of an annuity formula can be calculated by using the following steps: step 1: firstly, calculate the value of the future series of equal payments, which is denoted by p. step 2: next, calculate the effective rate of interest, which is basically the expected market interest rate divided by the number of.

Annuity Formula Calculation Examples With Excel Template 1.2 – annuity due. now we’ll find out the future value of the annuity due. steps: select cell c9. enter the following formula: =fv(c6,c7, c5,0,1) return the result by pressing enter. the accurate annuity due value is returned. read more: how to calculate future value in excel with different payments. Step 2) for the rate argument, refer to the interest rate. step 3) for the nper argument, refer to the number of years. step 4) for the nper argument, refer to the periodic payments to be made. step 5) omit the pv and type argument. step 6) and hit enter. excel returns the fv of this annuity as $256,611.41. This open access excel template is a useful tool for bankers, investment professionals, corporate finance practitioners, and portfolio managers. present value of annuity due is among the topics included in the quantitative methods module of the cfa level 1 curriculum. gain valuable insights into the subject with our math for finance course. Future value in excel. the future value (fv) is one of the key metrics in financial planning that defines the value of a current asset in the future. in other words, fv measures how much a given amount of money will be worth at a specific time in the future. normally, the fv calculation is based on an anticipated growth rate, or rate of return.

Comments are closed.