Future Value Of An Annuity Due Using Excel

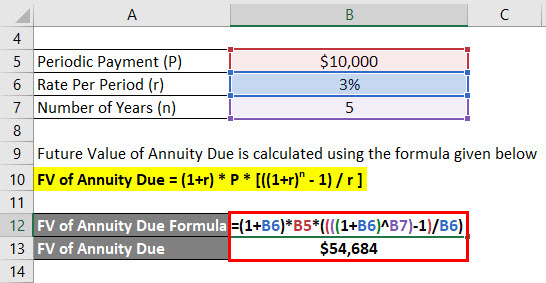

Future Value Of Annuity Due Formula Calculator Excel Template An annuity due is a repeating payment made at the beginning of each period, instead of at the end of each period. to calculate an annuity due with the fv function, set the type argument to 1: = fv (c5,c6, c4,0,1) with type set to 1, fv returns $338,382.35. to get the present value of an annuity, you can use the fv function. 1.2 – annuity due. now we’ll find out the future value of the annuity due. steps: select cell c9. enter the following formula: =fv(c6,c7, c5,0,1) return the result by pressing enter. the accurate annuity due value is returned. read more: how to calculate future value in excel with different payments.

Future Value Of Annuity Excel Formula Exceljet Step 5) omit the pv and type argument. step 6) and hit enter. excel returns the fv of this annuity as $256,611.41. here’s how excel calculated it. step 1) discount each year’s cash flow by using the following annuity formula. step 2) drag and drop the formula to 12 years. step 3) sum up the compounded cashflows. Procedures in excel. to calculate the present value of an annuity due in excel, you can use the pv function. the formula syntax is as follows: =pv(rate, nper, pmt, [fv], [type]) where: rate is the interest rate per period, nper is the total number of periods, pmt is the payment made each period (annuity payment), fv is the future value, and. This has been a guide to the future value of annuity due formula. here we discuss how to calculate the future value of annuity due along with practical examples. we also provide the future value of annuity due calculator with a downloadable excel template. you may also look at the following articles to learn more –. You can calculate the present or future value for an ordinary annuity or an annuity due using the formulas shown below. with ordinary annuities, payments are made at the end of a specific period.

Future Value Of Annuity Due Formula Calculator Excel Template This has been a guide to the future value of annuity due formula. here we discuss how to calculate the future value of annuity due along with practical examples. we also provide the future value of annuity due calculator with a downloadable excel template. you may also look at the following articles to learn more –. You can calculate the present or future value for an ordinary annuity or an annuity due using the formulas shown below. with ordinary annuities, payments are made at the end of a specific period. For example, if an individual wished to receive $1,000 per month for the next 15 years, and the stated annuity rate was 4%, they can use excel to determine the cost of setting up this offering. 1. insert the pv (present value) function. 2. enter the arguments. you need a one time payment of $83,748.46 (negative) to pay this annuity. you'll receive 240 * $600 (positive) = $144,000 in the future. this is another example that money grows over time. note: we receive monthly payments, so we use 6% 12 = 0.5% for rate and 20*12 = 240 for nper.

Comments are closed.