Future Value Of An Annuity Due Definition And How To Calculate It Accounting Hub

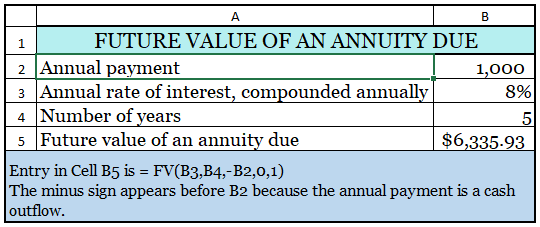

Future Value Of An Annuity Due Definition And How To Calculate It Accounting Hub Before we can calculate the fv of an annuity due (a), we need to calculate the future value interest factors of an annuity due by using the below formula: fvifa i , n (annuity due) = fvifa i, n × (1 i) where: fvifa = 5.867 (from the future value of an ordinary annuity table). i = 8%. n = 5. The future value of an annuity is a way of calculating how much money a series of payments will be worth at a certain point in the future. by contrast, the present value of an annuity measures how.

How To Calculate Annuity Factor C = cash flows per period. i = interest rate. n = number of payments. let's look at an example of the present value of an annuity due. suppose you are a beneficiary designated to immediately. The formula for calculating the future value of an annuity due (where a series of equal payments are made at the beginning of each of multiple consecutive periods) is: p = (pmt [ ( (1 r)n 1) r]) (1 r) where: this value is the amount that a stream of future payments will grow to, assuming that a certain amount of earnings gradually. Ordinary annuities and annuities due differ in the timing of those recurring payments. the future value of an annuity is the total value of payments at a future point in time. the present value is. Future value of an annuity = factor x annuity payment. factor = future value of an annuity annuity payment. = $30,200.99 $500. = 60.40198. because the annuity payments are made quarterly, we need to look at the fortieth period (10 years x 4) row until we find the factor (see the table above).

How To Calculate Future Value Annuity Due Haiper Ordinary annuities and annuities due differ in the timing of those recurring payments. the future value of an annuity is the total value of payments at a future point in time. the present value is. Future value of an annuity = factor x annuity payment. factor = future value of an annuity annuity payment. = $30,200.99 $500. = 60.40198. because the annuity payments are made quarterly, we need to look at the fortieth period (10 years x 4) row until we find the factor (see the table above). The first calculation is by looking at the future value of an ordinary annuity table and then substitute the fv interest factors of an ordinary annuity into the formula. fva= pmt × fvifa i, n. where: pmt = $1,000. fvifa 8%, 5 yrs = 5.867 (as per the future value of an ordinary annuity table). This refers to whether the annuity is an ordinary annuity that pays at the end of a period, such as the last day of the month, or annuity due that pays at the outset of a period, such as the first.

Future Value Of Annuity Due Formula Calculation With Examples The first calculation is by looking at the future value of an ordinary annuity table and then substitute the fv interest factors of an ordinary annuity into the formula. fva= pmt × fvifa i, n. where: pmt = $1,000. fvifa 8%, 5 yrs = 5.867 (as per the future value of an ordinary annuity table). This refers to whether the annuity is an ordinary annuity that pays at the end of a period, such as the last day of the month, or annuity due that pays at the outset of a period, such as the first.

Comments are closed.