Future Value Annuity Table Calculator Brokeasshome

Future Value Annuity Table Calculator Brokeasshome Future value of an annuity. f v = p m t i [(1 i) n − 1] (1 i t) where r = r 100, n = mt where n is the total number of compounding intervals, t is the time or number of periods, and m is the compounding frequency per period t, i = r m where i is the rate per compounding interval n and r is the rate per time unit t. To calculate the future value of an annuity: define the periodic payment you will do (p), the return rate per period (r), and the number of periods you are going to contribute (n). calculate: (1 r)ⁿ minus one and divide by r. multiply the result by p, and you will have the future value of an annuity.

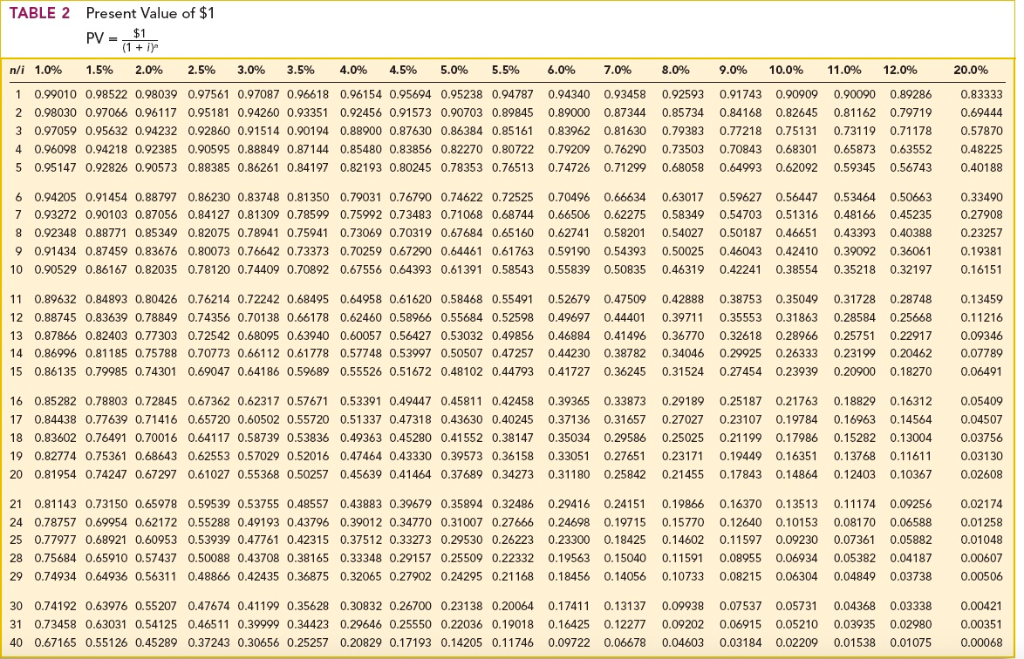

Future Value Annuity Table Calculator Brokeasshome The purpose of the future value annuity tables is to perform annuity calculations without the use of a financial calculator. the tables provide the value at the end of period n of an amount of 1 received at the end of each period for n periods at a discount rate of i%. the future value of an annuity formula is: fv = pmt x ((1 i)n 1) i. Future value of an annuity. f v = p m t i [(1 i) n − 1] (1 i t) where i is the interest rate per period and n is the total number of periods with compounding occurring once per period. since the annuity is payments of $1, pmt = $1 and we have. f v = $ 1 i [(1 i) n − 1] (1 i t) t represents the type of annuity (similar to excel. Click the “calculate” button to generate a table of future values. example: suppose you make monthly payments of $500 into an annuity with an annual interest rate of 6% for 10 years. by using our future value annuity table calculator, you can view a table displaying the future values for each year. faqs:. Following is the formula for finding future value of an ordinary annuity: fva = p * ( (1 i) n 1) i) where, fva = future value. p = periodic payment amount. n = number of payments. i = periodic interest rate per payment period, see periodic interest calculator for conversion of nominal annual rates to periodic rates.

Future Value Annuity Table Calculator Brokeasshome Click the “calculate” button to generate a table of future values. example: suppose you make monthly payments of $500 into an annuity with an annual interest rate of 6% for 10 years. by using our future value annuity table calculator, you can view a table displaying the future values for each year. faqs:. Following is the formula for finding future value of an ordinary annuity: fva = p * ( (1 i) n 1) i) where, fva = future value. p = periodic payment amount. n = number of payments. i = periodic interest rate per payment period, see periodic interest calculator for conversion of nominal annual rates to periodic rates. With the present annuity calculator, you can also find out the future value of a growing annuity. in the case of growing annuity, the amount of a series of cash flows, or payments, grows at a proportionate rate. the most straightforward growing annuity formula takes the following form: fv = p × ((1 r) n − (1 g) n) (r − g)) where:. We can ignore pmt for simplicity's sake. pressing calculate will result in an fv of $10.60. this means that $10 in a savings account today will be worth $10.60 one year later. the time value of money. fv (along with pv, i y, n, and pmt) is an important element in the time value of money, which forms the backbone of finance. there can be no such.

:max_bytes(150000):strip_icc()/CalculatingPresentandFutureValueofAnnuities2-9c9db03774fd45fc83501879e123f82d.png)

Future Value Annuity Table Calculator Brokeasshome With the present annuity calculator, you can also find out the future value of a growing annuity. in the case of growing annuity, the amount of a series of cash flows, or payments, grows at a proportionate rate. the most straightforward growing annuity formula takes the following form: fv = p × ((1 r) n − (1 g) n) (r − g)) where:. We can ignore pmt for simplicity's sake. pressing calculate will result in an fv of $10.60. this means that $10 in a savings account today will be worth $10.60 one year later. the time value of money. fv (along with pv, i y, n, and pmt) is an important element in the time value of money, which forms the backbone of finance. there can be no such.

Future Value Annuity Table Calculator Brokeasshome

Comments are closed.