Finance Basics 11 Annuity Due Calculation In Excel Present Value And Future Value

Present Value Of Annuity Due Formula Calculator With Excel Template Visit teachmsoffice for more, including excel consulting, macros, and tutorials.this excel video tutorial shows you how to calculate the annui. With an annuity due, payments are made at the beginning of the period, instead of the end. to calculate present value for an annuity due, use 1 for the type argument. in the example shown, the formula in f9 is: = pv (f7,f8, f6,0,1) note the inputs (which come from column f) are the same as the original formula. the only difference is type = 1.

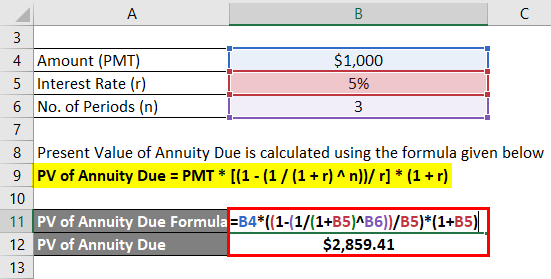

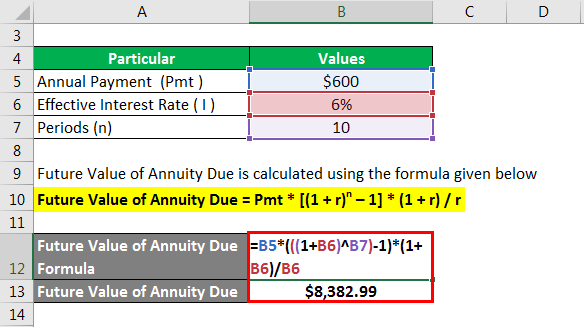

Present Value Of Annuity Due Table Excel Bruin Blog An annuity due is a repeating payment made at the beginning of each period, instead of at the end of each period. to calculate an annuity due with the fv function, set the type argument to 1: = fv (c5,c6, c4,0,1) with type set to 1, fv returns $338,382.35. to get the present value of an annuity, you can use the fv function. Step 5) omit the pv and type argument. step 6) and hit enter. excel returns the fv of this annuity as $256,611.41. here’s how excel calculated it. step 1) discount each year’s cash flow by using the following annuity formula. step 2) drag and drop the formula to 12 years. step 3) sum up the compounded cashflows. Method 1 – using a mathematical formula to calculate the present value of an annuity. the mathematical formula for ordinary annuity and present value of an annuity in excel is: pva ordinary = p * (1 – (1 r n)^ t*n) (r n) pva due = p * (1 – (1 r n)^ t*n) * ( (1 r n) (r n)) where, pva = present value of annuity. p = periodic payment. Her expertise is in personal finance and investing, and real estate. calculating the present value of an annuity using microsoft excel is a fairly straightforward exercise, as long as you know a.

Present Value Of Annuity Due Table Excel Bruin Blog Method 1 – using a mathematical formula to calculate the present value of an annuity. the mathematical formula for ordinary annuity and present value of an annuity in excel is: pva ordinary = p * (1 – (1 r n)^ t*n) (r n) pva due = p * (1 – (1 r n)^ t*n) * ( (1 r n) (r n)) where, pva = present value of annuity. p = periodic payment. Her expertise is in personal finance and investing, and real estate. calculating the present value of an annuity using microsoft excel is a fairly straightforward exercise, as long as you know a. The complete pv formula in b8 is: =pv(b2 b6, b3*b6, b4,, b5) in a similar manner, you can calculate the present value of a weekly, quarterly or semiannual annuity. for this, simply change the number of periods per year in the corresponding cell: weekly: 52. monthly: 12. Alternative formula for the present value of an annuity due. the present value of an annuity due formula can also be stated as. which is (1 r) times the present value of an ordinary annuity. this can be shown by looking again at the extended version of the present value of an annuity due formula of. this formula shows that if the present value.

Comments are closed.