Consumer Financial Protection Bureau Closing Disclosure

Closing Disclosure Explainer Consumer Financial Protection Bureau Closing disclosure explainer. use this tool to double check that all the details about your loan are correct on your closing disclosure. lenders are required to provide your closing disclosure three business days before your scheduled closing. use these days wisely—now is the time to resolve problems. In which the consumer must pay additional funds to satisfy the existing mortgage loan securing the property and other existing debt to consummate the transaction. download pdf. page 3 of closing disclosure (summaries of transactions) disclosure of consumer funds from a simultaneous second lien credit transaction.

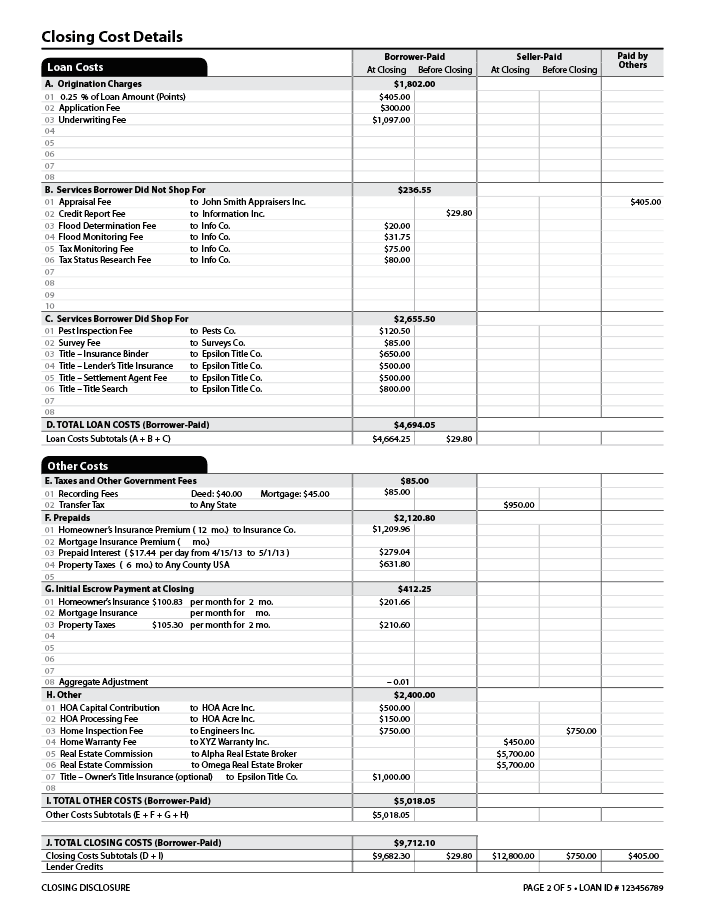

Closing Disclosure Explainer Consumer Financial Protection Bureau English. español. a closing disclosure is a five page form that provides final details about the mortgage loan you have selected. it includes the loan terms, your projected monthly payments, and how much you will pay in fees and other costs to get your mortgage (closing costs). the lender is required to give you the closing disclosure at least. Guide to the loan estimate and closing disclosure forms this guide is current as of the date set forth on the cover page. it has been updated to reflect the final rule issued on july 7, 2017 and published on august 11, 2017. november 2017 consumer financial protection bureau tila respa integrated disclosure guide to the loan estimate and. Sa month x other: homeowner’s associat. on dues nosee escrow account on page 4 for detai. ty costs separately.costs at closingclosing costs$9,712.10 includes $4,694.05 in loan costs. $5,018.05 in other cos. der credits. see page 2 for details. cash to close$14,147.26 includes closing costs. The closing disclosure may look official — and maybe a little intimidating at first. but don't assume the document is correct, advises the consumer financial protection bureau.

New Closing Disclosure Fillable Form Printable Forms Free Online Sa month x other: homeowner’s associat. on dues nosee escrow account on page 4 for detai. ty costs separately.costs at closingclosing costs$9,712.10 includes $4,694.05 in loan costs. $5,018.05 in other cos. der credits. see page 2 for details. cash to close$14,147.26 includes closing costs. The closing disclosure may look official — and maybe a little intimidating at first. but don't assume the document is correct, advises the consumer financial protection bureau. 9 consumer financial protection bureau 11.3 when is the closing disclosure considered to be received if it is delivered in person or if it is mailed? (§ 1026.19(f)(1)(iii)) 64 11.4 can a settlement agent provide the closing disclosure on the creditor’s behalf?. 2. get ready for closing. our closing checklist lets you know what to expect at closing and what questions to ask so you will be prepared. get our mortgage closing checklist. 3. review the rest of your closing documents. in addition to your closing disclosure, there are other important documents you will need to sign at closing, such as the.

Comments are closed.