Calculating Present And Future Value Of Annuities

:max_bytes(150000):strip_icc()/CalculatingPresentandFutureValueofAnnuities5-d76f3a6c09a54703afa365a16aff6607.png)

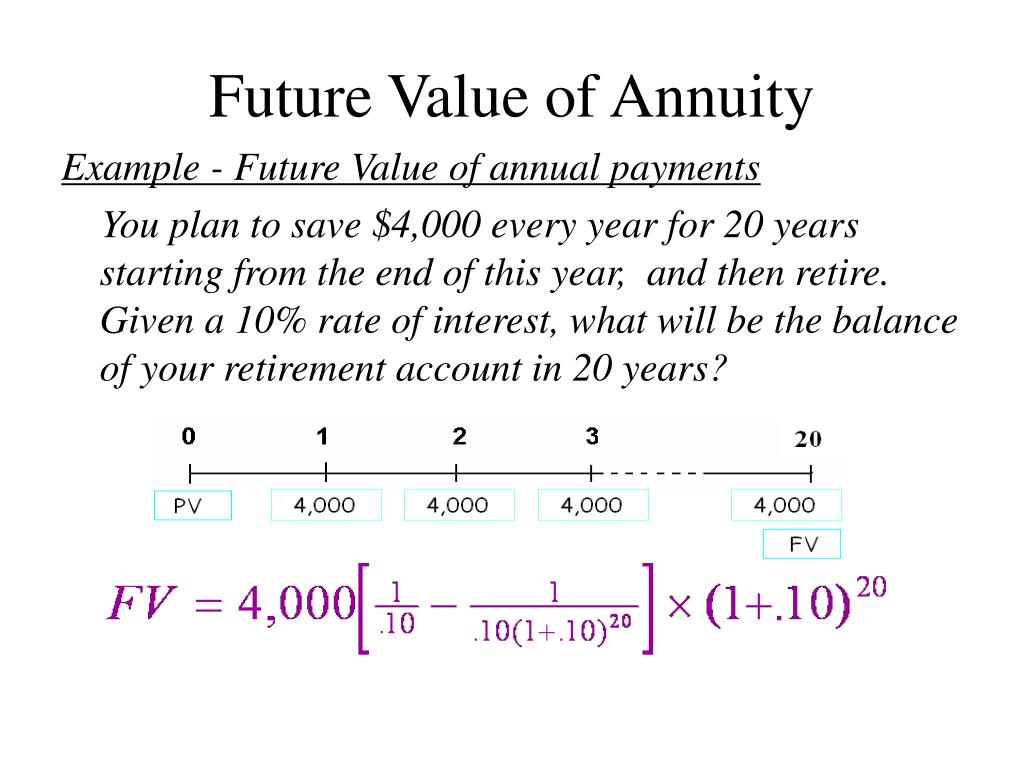

Calculating Present And Future Value Of Annuities Ordinary annuities and annuities due differ in the timing of those recurring payments. the future value of an annuity is the total value of payments at a future point in time. the present value is. Multiply this result by (1 i): 5.53 x (1 0.05) ≈ 5.8019. therefore, the future value of your annuity due with $1,000 annual payments at a 5 percent interest rate for five years would be.

Annuity Formula Present Future Value Ordinary Due Annuities Efm The present value of an annuity is the current value of future payments from an annuity, given a specified rate of return, or discount rate. the higher the discount rate, the lower the present. The present value of an annuity is the total value of all of future annuity payments. a key factor in determining the present value of an annuity is the discount rate. this can be an expected. The future value of an annuity is a way of calculating how much money a series of payments will be worth at a certain point in the future. by contrast, the present value of an annuity measures how. Here’s the present value annuity formula: pmt x [ (1 – [1 (1 r)^n]) r] = the present value of the annuity. and here’s what each variable means: pmt: the amount the annuity pays you per period. r: the interest rate per period. n: the number of expected payment periods.

Calculating Present And Future Value Of Annuities Youtube The future value of an annuity is a way of calculating how much money a series of payments will be worth at a certain point in the future. by contrast, the present value of an annuity measures how. Here’s the present value annuity formula: pmt x [ (1 – [1 (1 r)^n]) r] = the present value of the annuity. and here’s what each variable means: pmt: the amount the annuity pays you per period. r: the interest rate per period. n: the number of expected payment periods. Multiply this result by (1 i): 5.53 x (1 0.05) ≈ 5.8019. therefore, the future value of your annuity due with $1,000 annual payments at a 5 percent interest rate for five years would be. Future value of an annuity. f v = p m t i [(1 i) n − 1] (1 i t) where r = r 100, n = mt where n is the total number of compounding intervals, t is the time or number of periods, and m is the compounding frequency per period t, i = r m where i is the rate per compounding interval n and r is the rate per time unit t.

How To Calculate Future Value Rate Haiper Multiply this result by (1 i): 5.53 x (1 0.05) ≈ 5.8019. therefore, the future value of your annuity due with $1,000 annual payments at a 5 percent interest rate for five years would be. Future value of an annuity. f v = p m t i [(1 i) n − 1] (1 i t) where r = r 100, n = mt where n is the total number of compounding intervals, t is the time or number of periods, and m is the compounding frequency per period t, i = r m where i is the rate per compounding interval n and r is the rate per time unit t.

:max_bytes(150000):strip_icc()/CalculatingPresentandFutureValueofAnnuities1-0cea56f3b4514e44bed8f45d9c74011e.png)

Calculating Present And Future Value Of Annuities

Comments are closed.