Annuityf Table Factor Annuity

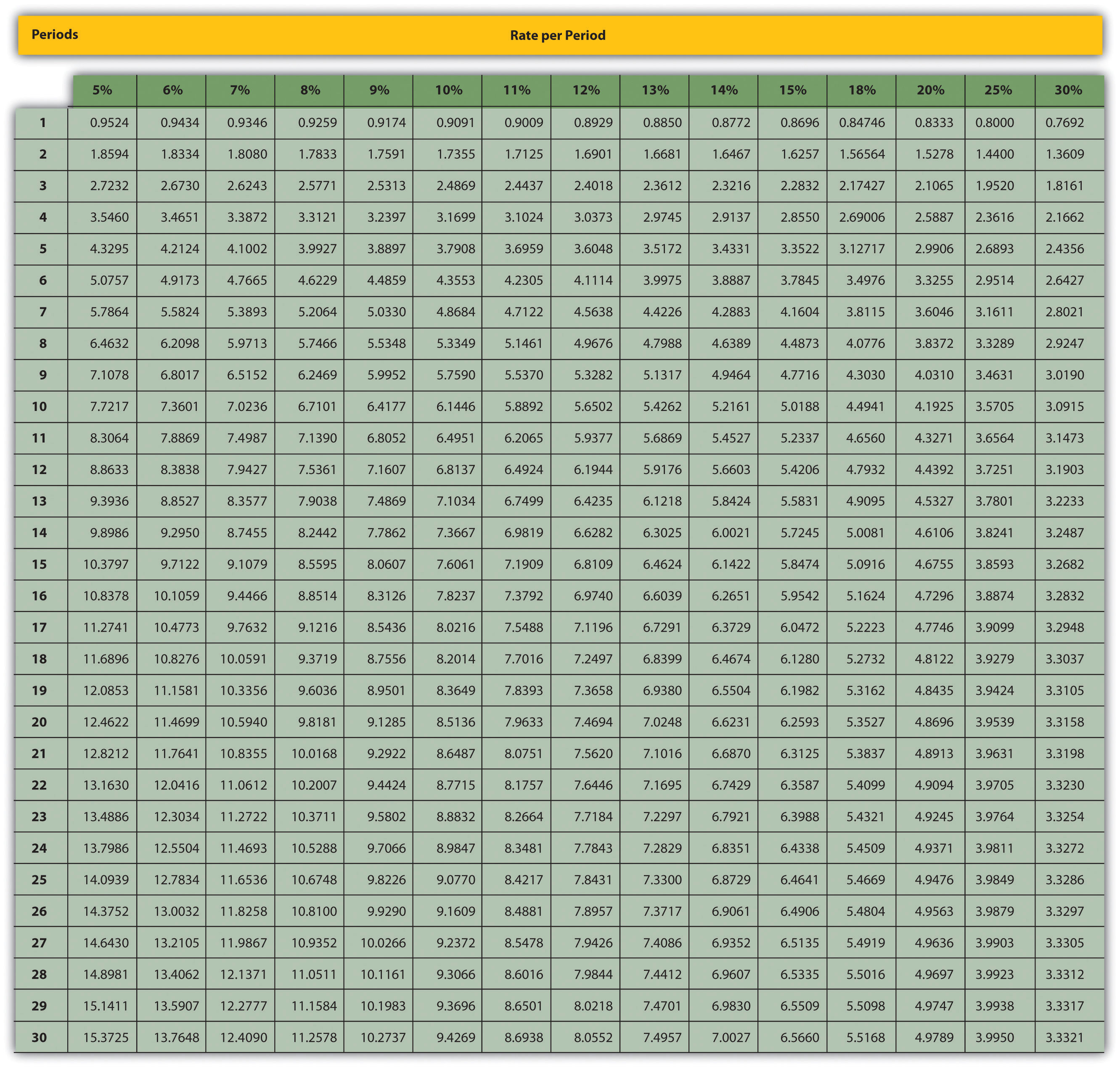

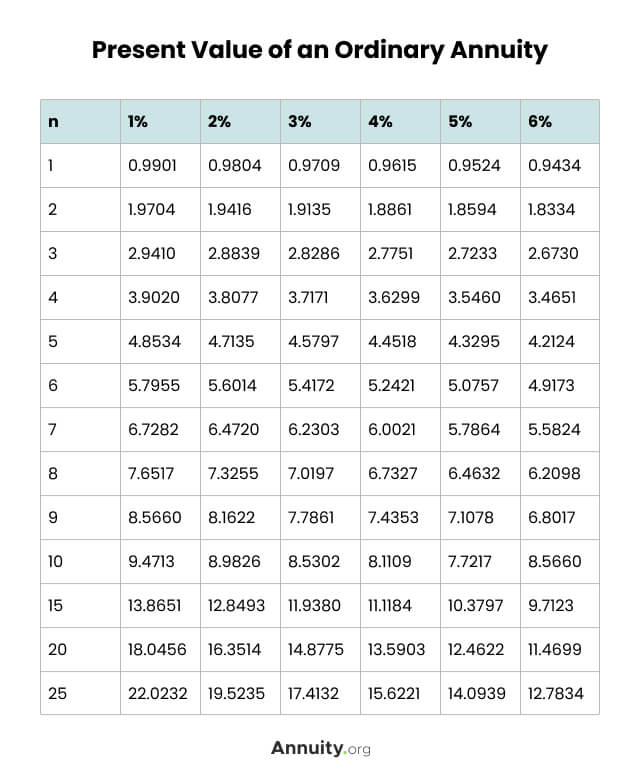

Annuityf Npv Annuity Factor Table An annuity table, often referred to as a “present value table,” is a financial tool that simplifies the process of calculating the present value of an ordinary annuity. by finding the present value interest factor of an annuity (pvifa) on the table, you can easily determine the current worth of your annuity payments. get an annuity quote. The present value of an annuity formula is: pv = pmt x (1 1 (1 i)n) i. as can be seen present value annuity tables can be used to provide a solution for the part of the present value of an annuity formula shown in red. additionally this is sometimes referred to as the present value annuity factor. pv = pmt x present value annuity factor.

Annuityf Npv Annuity Factor Table The formula for calculating the present value of an ordinary annuity is: p = pmt [ (1 (1 (1 r)n)) r] where: p = the present value of the annuity stream to be paid in the future. pmt = the amount of each annuity payment. r = the interest rate. n = the number of periods over which payments are made. an annuity table is used to determine. An annuity table is a tool for determining the present value of an annuity or other structured series of payments. if you multiply this 12.7834 factor from the annuity table by the $50,000. An annuity table, which involves plenty of arithmetic, tells you the present value of an looking at the table, you’d find the factor that corresponds with 10 periods at a discount rate of 5%. By looking at a present value annuity factor table, the annuity factor for 5 years and 5% rate is 4.3295. this is the present value per dollar received per year for 5 years at 5%. therefore, $500 can then be multiplied by 4.3295 to get a present value of $2164.75.

What Is An Annuity Table And How Do You Use One An annuity table, which involves plenty of arithmetic, tells you the present value of an looking at the table, you’d find the factor that corresponds with 10 periods at a discount rate of 5%. By looking at a present value annuity factor table, the annuity factor for 5 years and 5% rate is 4.3295. this is the present value per dollar received per year for 5 years at 5%. therefore, $500 can then be multiplied by 4.3295 to get a present value of $2164.75. The present value interest factor of an annuity is used to calculate the present value of a series of annuities when it is multiplied by the recurring payment amount. the initial deposit earns. Present value of an annuity due (pvad) otherwise t = 1 and the equation reduces to the formula for present value of an annuity due. p v a d = $ 1 i [1 − 1 (1 i) n] (1 i) you can then look up the present value interest factor in the table and use this value as a factor in calculating the present value of an annuity, series of payments.

Comments are closed.