Annuity Due Formula Example With Excel Template

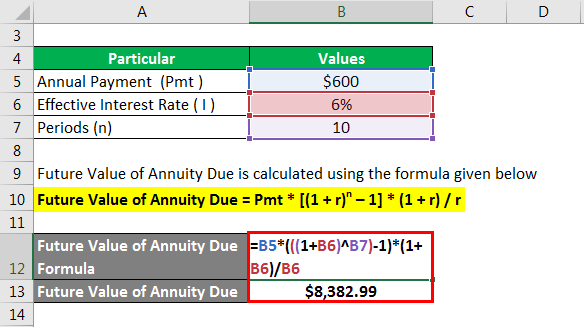

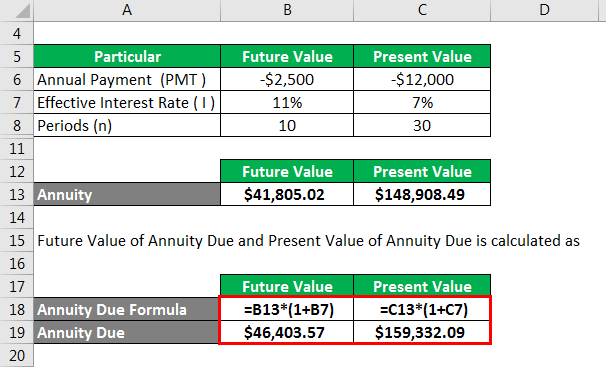

Annuity Due Formula Example With Excel Template Future value of annuity due = 600 * ((1 6%) 10 – 1) * (1 6%)) 6% future value of annuity due = $8,382.99 annuity due formula – example #2. let us look at an example of calculation of present and future value of an annuity due using the excel formula. Steps: select a cell (c9) where you want to calculate the annuity payment, the future value. enter the corresponding formula in the c9 cell: =fv(c6,c7,c5) press enter to get the future value. formula breakdown. here, the fv function will return a future value of the periodic investment.

Annuity Due Formula Example With Excel Template Step 2) for the rate argument, refer to the interest rate. step 3) for the nper argument, refer to the number of years. step 4) for the nper argument, refer to the periodic payments to be made. step 5) omit the pv and type argument. step 6) and hit enter. excel returns the fv of this annuity as $256,611.41. For calculation of the future value of an annuity, we can use the above formula: future value of annuity due = (1 5.00%) x 1000. future value of an annuity due will be . future value of an annuity=$ 5,801.91. therefore, the future value of the annual deposit of $1,000 will be $5,801.91. The formula to calculate the present value of an annuity due is given by: where: is the present value of the annuity due, is the payment amount, is the interest rate per period, and; is the total number of periods. procedures in excel. to calculate the present value of an annuity due in excel, you can use the pv function. the formula syntax is. We also provide an annuity calculator with a downloadable excel template. you may also look at the following articles to learn more – formula for future value of annuity due; calculator for time value of money formula; examples of discount factor formula; present value factor formula with excel template; future value of an annuity formula.

Present Value Of Annuity Due Table Excel Bruin Blog The formula to calculate the present value of an annuity due is given by: where: is the present value of the annuity due, is the payment amount, is the interest rate per period, and; is the total number of periods. procedures in excel. to calculate the present value of an annuity due in excel, you can use the pv function. the formula syntax is. We also provide an annuity calculator with a downloadable excel template. you may also look at the following articles to learn more – formula for future value of annuity due; calculator for time value of money formula; examples of discount factor formula; present value factor formula with excel template; future value of an annuity formula. With an annuity due, payments are made at the beginning of the period, instead of the end. to calculate the payment for an annuity due, use 1 for the type argument. in the example shown, the formula in c11 is: = pmt (c6,c7,c4,c5,1) which returns $7,571.86 as the payment amount. notice the only difference in this formula is type = 1. Pv of annuity due = $1,000 * [(1 – (1 (1 5%)^3)) 5%] * (1 5%) pv of annuity due = $2,859.41; pv of annuity due formula – example #2. company abc private limited wants to purchase machinery in the installment purchase system method, and it will the third party an amount of $100,000 at the start of each year for the next 8 years.

Comments are closed.