Annuities How To Calculate The Future Value Of An Annuity Due Youtube

Future Value Of An Annuity Due Youtube This finance video tutorial explains how to calculate the future value of an annuity due using a formula and using a step by step process. the future value. Annuities due: calculating future value with regular investments in this video, we'll explore how to calculate the future value of an annuity due when inv.

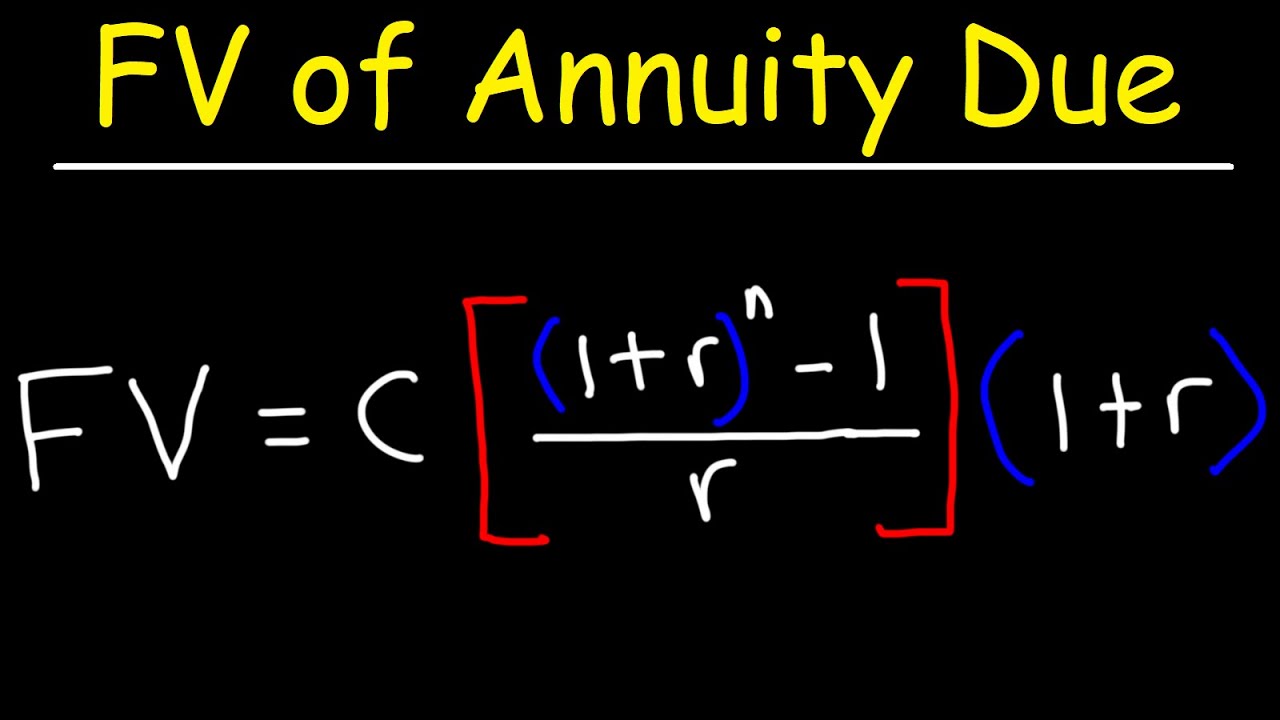

Annuities How To Calculate The Future Value Of An Annuity Due Youtube This finance video tutorial explains how to calculate the future value of an ordinary annuity using a formula. you need to know the amount of money being de. You can calculate the present or future value for an ordinary annuity or an annuity due using the formulas shown below. with ordinary annuities, payments are made at the end of a specific period. Future value of an annuity. f v = p m t i [(1 i) n − 1] (1 i t) where r = r 100, n = mt where n is the total number of compounding intervals, t is the time or number of periods, and m is the compounding frequency per period t, i = r m where i is the rate per compounding interval n and r is the rate per time unit t. To calculate the future value of an annuity: define the periodic payment you will do (p), the return rate per period (r), and the number of periods you are going to contribute (n). calculate: (1 r)ⁿ minus one and divide by r. multiply the result by p, and you will have the future value of an annuity.

Annuities Annuity Due Finding Future Value Youtube Future value of an annuity. f v = p m t i [(1 i) n − 1] (1 i t) where r = r 100, n = mt where n is the total number of compounding intervals, t is the time or number of periods, and m is the compounding frequency per period t, i = r m where i is the rate per compounding interval n and r is the rate per time unit t. To calculate the future value of an annuity: define the periodic payment you will do (p), the return rate per period (r), and the number of periods you are going to contribute (n). calculate: (1 r)ⁿ minus one and divide by r. multiply the result by p, and you will have the future value of an annuity. Here’s the present value annuity formula: pmt x [ (1 – [1 (1 r)^n]) r] = the present value of the annuity. and here’s what each variable means: pmt: the amount the annuity pays you per period. r: the interest rate per period. n: the number of expected payment periods. Fv due = future value of an annuity due pmt = payment amount i = interest rate n = number of payments the main difference here is multiplying by “1 plus the interest rate.” future value of growing annuities. a growing annuity is an annuity whose payments increase over time. in this case, the formula is:.

Future Value Of An Annuity Due Formula With Examples Youtube Here’s the present value annuity formula: pmt x [ (1 – [1 (1 r)^n]) r] = the present value of the annuity. and here’s what each variable means: pmt: the amount the annuity pays you per period. r: the interest rate per period. n: the number of expected payment periods. Fv due = future value of an annuity due pmt = payment amount i = interest rate n = number of payments the main difference here is multiplying by “1 plus the interest rate.” future value of growing annuities. a growing annuity is an annuity whose payments increase over time. in this case, the formula is:.

Comments are closed.